The $6.2 million Banana: Analyzing the Cult of Celebrity and Consumerism

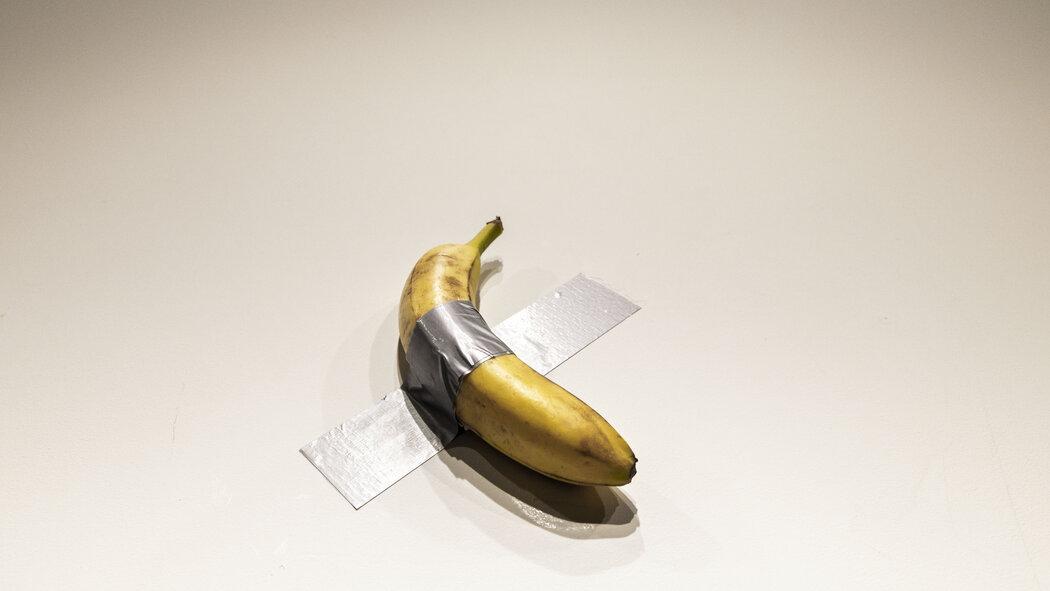

In a world where a simple banana taped to a wall can fetch a staggering $6.2 million at auction, one must question the values that underpin contemporary culture. This absurdity is not merely a reflection of artistic innovation but rather a symptom of a broader societal obsession with celebrity and consumerism.The banana, a piece by Italian artist Maurizio Cattelan, became a meatball in the multifaceted discourse around worth and meaning in art. It symbolizes how celebrity culture elevates mundane objects into coveted items, compelling collectors and enthusiasts alike to pay exorbitant amounts for a fleeting moment of recognition in a world swamped by digital noise. The phenomenon highlights the fragility of perceived value and how it can be manipulated through cultural cachet rather than intrinsic quality.

Simultaneously, this incident raises questions about the implications of consumerist behaviors tied to social media and celebrity endorsements. The interplay of art and commerce often sees individuals treating the acquisition of rare items as badges of honor, fostering a system where the lines between wealth, status, and artistry blur disturbingly. Moreover, as the rise of cryptocurrency continues to merge with traditional markets, there is an emerging crypto empire that thrives on such extravagant trends. amidst these striking developments, figures like Donald Trump emerge as either players or bystanders in this evolving landscape, prompting inquiries into thier own potential conflicts of interest within this lucrative, if whimsical, marketplace. are they mere spectators in a finely choreographed display of excess, or do they strategically engage in these dynamics, further entrenching their own narratives and influence within the ever-shifting tectonic plates of modern capitalism?

Unpacking the Crypto Empire: Opportunities and Risks in the Digital Currency Landscape

The rise of digital currencies has transformed not only how we perceive money but also how enormous financial ecosystems function. The allure of blockchain technology and decentralized finance creates a veritable gold rush,attracting investors,innovators,and speculators alike. Investors are lured by the promise of high returns, while businesses are compelled to adapt to this new landscape, leading to an explosion of new opportunities. Key advantages include:

- accessibility: Digital currencies can be accessed by anyone with an internet connection, democratizing finance.

- Lower Transaction Costs: Just a few pennies in fees compared to traditional banking, especially for international transactions.

- investment Diversification: A new asset class that can potentially hedge against traditional market downturns.

Though, these opportunities are accompanied by inherent risks that must not be overlooked. The volatility of cryptocurrencies presents formidable challenges for investors, leading to extreme fluctuations in asset values that can result in significant losses. additionally, the landscape is rife with regulatory uncertainty, leaving investors vulnerable to sudden policy changes. Notable concerns include:

- Fraud and Scams: Rapid growth has attracted malicious actors, raising questions about security and reliability.

- Market manipulation: The nascent market can be susceptible to pump-and-dump schemes, undermining investor confidence.

- Environmental Impact: The energy-intensive nature of mining cryptocurrencies raises sustainability concerns.

Trumps Potential Conflicts: Navigating Ethical Dilemmas in Business and Politics

The public discourse surrounding Trump has taken a curious turn, spotlighting an array of potential conflicts that intertwine his business ventures with his political ambitions. A striking illustration of this complex dynamic emerged with his recent investment in an unconventional market—a $6.2 million banana painting that has raised eyebrows across different sectors.This extravagant purchase, while seemingly eccentric, opens up discussions regarding the implications of personal wealth on political integrity. critics have raised concerns about how such grandiose financial decisions might influence his policymaking or serve as a means to curry favor with his affluent associates, further blurring the lines between personal gain and public duty.

Additionally, the landscape of digital currencies presents another layer of ethical ambiguity. Trump’s interests in various cryptocurrency ventures could create significant conflicts, particularly as these markets often operate in regulatory gray areas. The prospect of a cryptocurrency empire, intertwined with political ambitions, raises questions about accountability and transparency. Stakeholders are increasingly wary of potential advantages that may arise if he were to leverage his political power to enrich his financial portfolio. Observers are left to ponder the ramifications of such a dual existence, urging an examination of whether the former president can truly navigate these treacherous waters without jeopardizing the principles of democratic governance. Moreover, this situation necessitates a closer look at the legislation that governs elected officials’ financial interests and its enforcement in these uniquely modern scenarios.

Recommendations for Transparency: Ensuring Accountability in High-Stakes Ventures

In the complex landscape of high-stakes ventures, one of the most effective strategies for fostering trust and integrity is the implementation of robust transparency measures. These measures should include a commitment to publicly disclose financial statements, ensuring that all stakeholders have insight into the fiscal health and decision-making processes of the involved parties. Furthermore, regular audits conducted by independent third parties can serve as a crucial check, bolstering confidence among investors and the general public alike. Additional recommendations for enhancing transparency can comprise:

- Clear Interaction Channels: Establishing open lines of communication that allow stakeholders to voice concerns and receive timely updates.

- Stakeholder Engagement: Actively involving stakeholders in decision-making processes to reflect their interests and maintain trust.

- conflict of Interest Policies: Instituting stringent rules that require the disclosure of potential conflicts, particularly for individuals in influential positions.

As high-profile ventures continue to navigate public scrutiny and potential conflicts of interest—like the intertwining fortunes of a $6.2 million banana and crypto enterprises—the importance of clear practices cannot be overstated. Exploring mechanisms that facilitate accountability is essential, especially in settings where significant financial resources are at stake. By prioritizing transparency, stakeholders can mitigate risks associated with ethical lapses and reinforce a culture of responsibility that can withstand the pressures of ambition and profit.