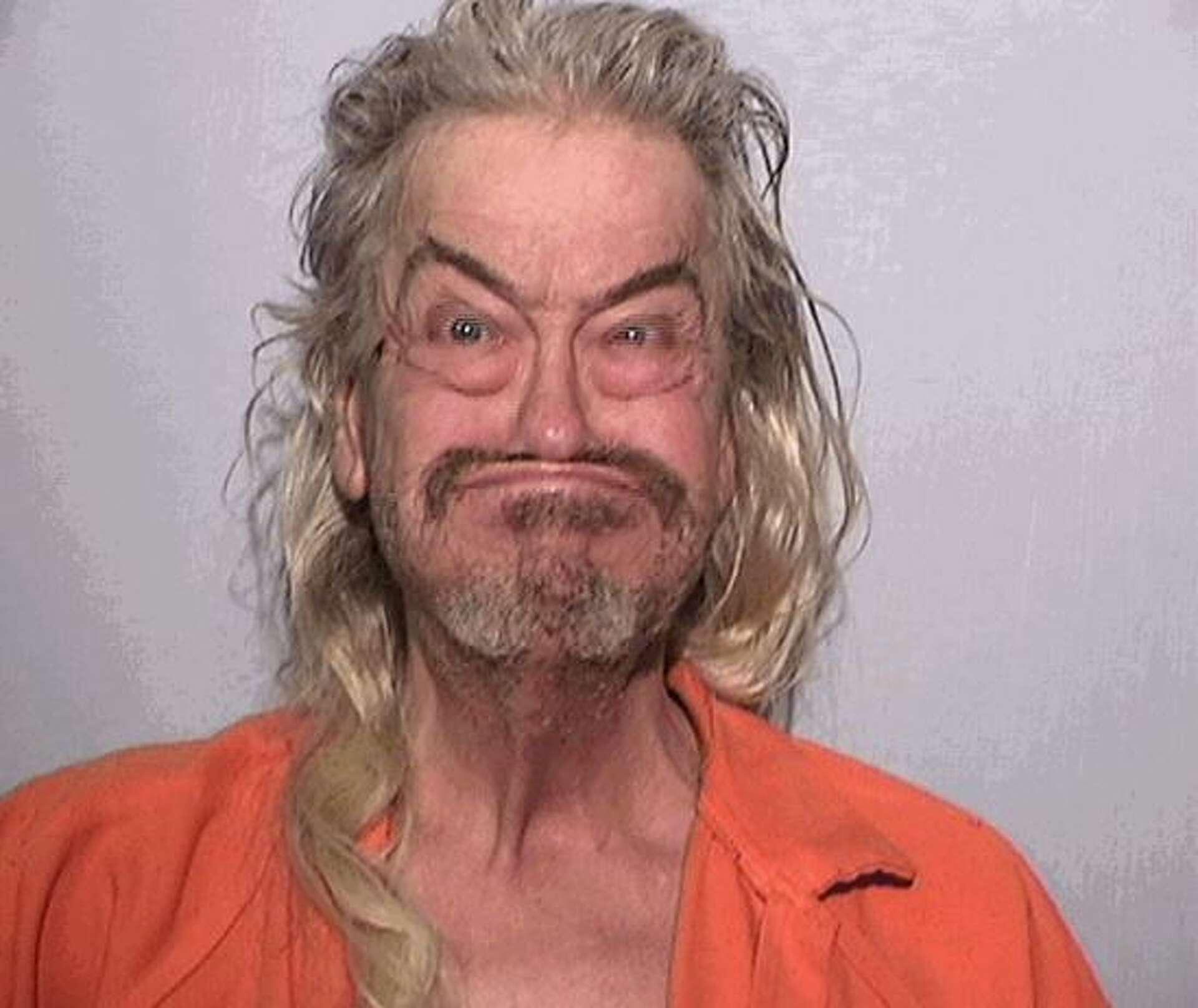

Ohio Mans Bitcoin Laundering Scheme: A Deep Dive into the Criminal Operations

In a remarkable turn of events, an Ohio man has been convicted of orchestrating a sophisticated Bitcoin laundering scheme that has raised eyebrows across the financial and legal sectors. The elaborate operation not only showcased the risks associated with cryptocurrency but also highlighted the vulnerabilities within regulatory frameworks that struggle to keep pace with technological advancements. Over the course of the investigation, authorities uncovered intricate methods employed by the perpetrator to convert illicit gains into seemingly legitimate fortunes. Some key elements of the operation included:

- Complex Layering Techniques: Utilizing multiple wallets to obscure transaction trails.

- Use of Mixing Services: Leveraging cryptocurrency mixers to enhance anonymity.

- International Transactions: Engaging with foreign exchanges to further distance funds from their criminal origins.

The gravity of the situation was further underscored by the staggering forfeiture of over $400 million in assets, a financial blow that reflects the magnitude of his illicit operations. This case not only serves as a cautionary tale for crypto investors and criminals alike but also prompts a broader discussion on the need for stricter legislation and oversight in the cryptocurrency space. Experts believe that the outcome of this case may serve as a precedent, potentially leading to more rigorous investigations and enforcement actions against similar financial crimes. Elements that may influence future regulatory changes include:

- Increased Compliance Requirements: Demanding transparency from cryptocurrency exchanges.

- Enhanced International Cooperation: Strengthening cross-border regulatory frameworks.

- Public Awareness Campaigns: Educating consumers about the risks associated with cryptocurrency investment.

The Financial Fallout: Understanding the $400 Million Asset Forfeiture

The recent court ruling that mandates the forfeiture of over $400 million in assets from an Ohio man convicted of Bitcoin laundering represents a significant development in the fight against cybercrime and financial corruption. The sheer scale of this asset forfeiture not only underscores the severity of the offenses committed but also illustrates the growing recognition among law enforcement and judicial authorities of cryptocurrency’s potential for facilitating illicit activities. The convicted individual, whose operations spanned various jurisdictions, utilized complex layers of transactions to obscure the origins of these funds, entangling himself in a web of legal and financial scrutiny.

This landmark case serves as a warning to those engaged in similar activities and highlights several key points in the broader discussion on cryptocurrency regulation and compliance:

- Increased scrutiny: Regulatory bodies are sharpening their focus on cryptocurrency transactions, signaling that anonymity in crypto dealings is not a shield against law enforcement.

- Legal repercussions: The significant financial penalties attached to such crimes indicate that the legal system is prepared to impose severe consequences on individuals who attempt to exploit digital currency for unlawful gains.

- Impact on the crypto market: Such high-profile cases may lead to increased calls for regulation within the crypto sphere, influencing market dynamics and investor confidence.

Lessons Learned: Strengthening Regulatory Frameworks Against Cryptocurrency Crimes

The recent conviction of an Ohio man for Bitcoin laundering serves as a stark reminder of the vulnerabilities present in the current cryptocurrency landscape. Despite the rapid advancement and popularity of digital currencies, regulatory frameworks have struggled to keep pace with evolving criminal tactics. The need for comprehensive and robust regulations has never been more urgent, as illicit activities continue to exploit gaps in existing laws. This case spotlights crucial areas where authorities can enhance their approach, including:

- Stricter KYC (Know Your Customer) Regulations: Ensuring that cryptocurrency exchanges implement rigorous identification and verification processes.

- Enhanced Monitoring Tools: Investing in advanced technology for tracking cryptocurrency transactions and identifying suspicious activities.

- Interagency Collaboration: Promoting better communication and cooperative efforts between regulatory bodies, law enforcement, and financial institutions.

- Public Awareness Campaigns: Educating consumers about the risks associated with cryptocurrency investments and laundering schemes.

As regulators assess the implications of this case, the focus must shift from reactive measures to preemptive strategies that mitigate risks associated with cryptocurrency crimes. The importance of adaptive regulatory frameworks cannot be understated; they should not only respond to the current threats but also anticipate future challenges. By fostering an environment of compliance and accountability, authorities can effectively safeguard both investors and the integrity of the digital currency ecosystem. Key recommendations moving forward include:

- Establishing Clear Legal Definitions: Clarifying what constitutes cryptocurrency-related crimes to streamline prosecution.

- Encouraging Self-Regulation: Promoting initiatives within the cryptocurrency industry to adopt best practices and ethical standards.

- Regular Policy Reviews: Instituting periodic reviews of regulations to adapt to the ever-changing technological landscape.

- Engaging International Partners: Collaborating with global regulatory bodies to address transnational cryptocurrency crime.

Future Implications: How This Case Could Shape Bitcoin Regulations Nationwide

The recent ruling against an Ohio man found guilty of Bitcoin laundering marks a potentially pivotal moment in the evolving landscape of cryptocurrency regulation. As authorities begin to outline the legal consequences of using digital currencies for illicit activities, this case could serve as a cornerstone for establishing more stringent legislative frameworks at both state and federal levels. With over $400 million in assets now ordered for forfeiture, regulators may feel emboldened to pursue similar cases that could deter fraudulent behaviors and promote compliance within the rapidly growing cryptocurrency market.

Industry experts suggest that the implications of this ruling could extend beyond punitive measures. Key outcomes could include:

- A clearer legal definition of what constitutes money laundering in the context of cryptocurrencies.

- Enhanced monitoring and reporting requirements for exchanges and financial institutions engaged in crypto transactions.

- Increased collaboration between federal and state agencies to combat the misuse of digital assets.

As lawmakers and regulatory bodies assess the ramifications of this case, the resultant shift may cultivate an environment where transparency and accountability are prioritized, ultimately fostering sustainable growth in the cryptocurrency space.