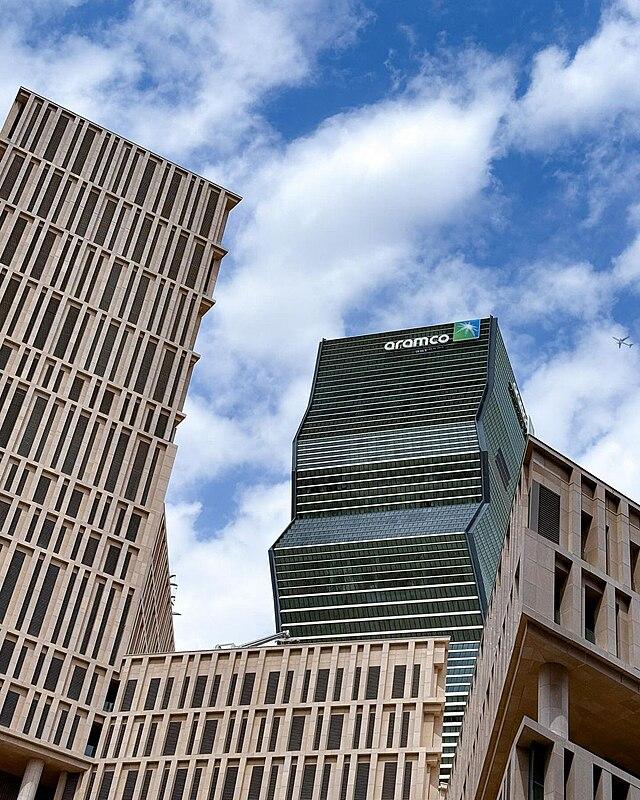

Aramcos Strategic Investment in Saudi Startups: A New Era of Innovation

In a move that underscores its commitment too fostering innovation and economic diversification, Aramco’s venture arm has participated in a significant $30 million funding round for a promising Saudi startup. This initiative not only reflects the oil giant’s strategic pivot towards technology and lasting industries but also highlights a growing trend of corporate investment in local enterprises that are reshaping the technological landscape of the Kingdom. The startup, whose focus lies in developing groundbreaking solutions tailored for various sectors, stands as a testament to the rich potential that Saudi entrepreneurs are harnessing amidst a backdrop of rapid economic conversion.

The backing from Aramco’s venture arm is expected to catalyze further growth and innovation within the startup ecosystem in Saudi arabia. by investing in local startups, Aramco aims to achieve several key objectives:

- Promotion of Technology Adoption: Accelerating the integration of advanced technologies in traditional industries.

- Diversity in Economic activities: Reducing dependence on oil by supporting sectors such as renewable energy,health tech,and digital solutions.

- Job Creation: Generating employment opportunities in high-growth sectors, contributing to the Kingdom’s Vision 2030 objectives.

This strategic investment not only reinforces Aramco’s position as a key player in the Kingdom’s economic landscape but also signifies a broader movement towards a more sustainable and innovative economic future.

Evaluating the Impact of Aramcos Venture Arm on the Saudi Tech Ecosystem

Aramco’s venture arm continues to assert its influence over the burgeoning tech landscape in Saudi Arabia, as evidenced by its significant participation in the recent $30 million funding round for a local startup. This growth marks a pivotal moment for the ecosystem, showcasing the commitment of established conglomerates to invest in innovative technology solutions. The backing from Aramco not only provides financial stability but also validates the startup’s vision, attracting further interest from other investors and industry players keen on tapping into the region’s potential.

The implications of Aramco’s investment extend beyond mere capital infusion. Through strategic partnerships and mentorship, the venture arm enhances the startup’s operational capabilities and market reach. This creates a ripple effect, encouraging other corporations to engage similarly with the tech sector. Key factors contributing to this evolving dynamic include:

- Access to Resources: startups gain invaluable insights from Aramco’s extensive network and industry expertise.

- Market Credibility: Endorsements from a leading name in energy solidify the legitimacy of the emerging tech venture.

- Innovation Drive: The infusion of capital fuels research and development, propelling new technological advancements.

Harnessing Opportunities: Key Sectors for Future investments in Saudi Arabia

Amid the rapid evolution of its economy, Saudi Arabia is increasingly becoming a hub for innovative startups across various sectors.The recent investment by Aramco’s venture arm underscores the kingdom’s commitment to fostering a dynamic entrepreneurial ecosystem.This strategic move not only enhances Aramco’s portfolio but also highlights key sectors that are ripe for investment,including:

- Renewable Energy: With its Vision 2030 initiative,Saudi Arabia is prioritizing sustainable energy sources,making it an attractive landscape for clean tech startups.

- Technology and Digital Services: As the nation digitizes, there is a surge in opportunities within fintech, e-commerce, and software development that promises high returns.

- Healthcare Innovation: Investing in health tech solutions is crucial, especially in light of heightened focus on public health and healthcare accessibility.

- Tourism and Entertainment: As the kingdom opens its doors to international tourism,there’s significant potential for startups in hospitality,entertainment,and cultural promotion.

This influx of capital not only propels the growth of individual startups but also fuels a broader economic transformation. Investors are drawn to the robust regulatory framework and government support aimed at encouraging entrepreneurship, making Saudi Arabia a focal point for venture capital. The collaboration between established entities like Aramco and emerging startups signals a promising future where innovation and traditional industries converge, paving the way for new job creation and technological advancements across the region.

Recommendations for Emerging Startups Seeking Funding in a Competitive Landscape

As emerging startups navigate the complexities of securing funding in today’s crowded market, a strategic approach is essential for attracting investors. Startups are encouraged to focus on crafting a compelling narrative around their unique value proposition. An articulate story that outlines innovation, market potential, and clear differentiation can captivate potential backers. Furthermore, building a robust network is crucial.Engaging with mentors, industry professionals, and previous investors can create beneficial introductions and enhance credibility within the investment community.

To further bolster their appeal,startups should prioritize the following strategies:

- Data-Driven Metrics: Present clear metrics that showcase traction and potential growth,including user acquisition rates and revenue milestones.

- Articulate a Clear Vision: Clearly communicate both short-term goals and long-term vision to demonstrate sustainability.

- Diversify Funding Sources: Explore various funding avenues such as angel investors, venture capital, crowdfunding, and government grants to mitigate reliance on a single source.

- Focus on Problem-Solving: Highlight how your startup addresses specific pain points within the target market, making it more relatable to investors.