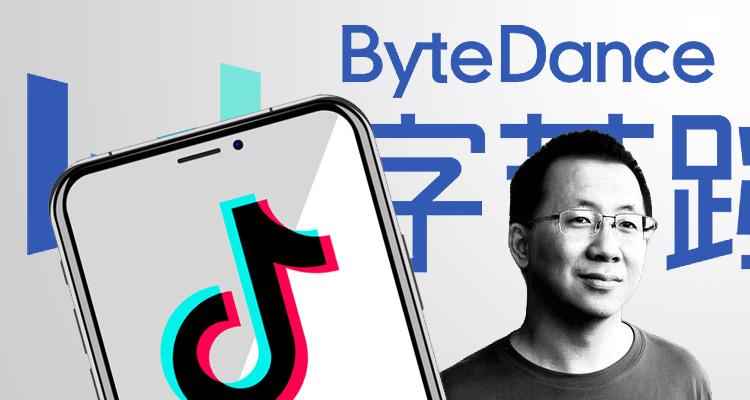

ByteDance’s Strategic Share Buyback: Insights into the $312 Billion valuation

ByteDance has announced a strategic move to buy back shares from its U.S. employees, a decision that comes amidst a turbulent valuation landscape in the tech industry.At a staggering valuation of $312 billion, this initiative reflects the company’s commitment to its workforce while also serving as a stabilizing factor in a volatile market. Analysts are keenly observing this maneuver as it could potentially reshape stakeholder confidence and enhance investor sentiment towards the company. by reaching out to its U.S. employees in this manner, ByteDance reinforces its intent to foster loyalty and retain top talent in a highly competitive surroundings.

the buyback program is indicative of bytedance’s robust financial health, showcasing its ability to generate substantial cash flow even in challenging economic times. This initiative may provide several benefits, including:

- Enhancing employee morale as they see tangible value in their contributions.

- Mitigating stock volatility associated with external market pressures.

- Reinforcing the perception of ByteDance as a leader in the tech sector who is attentive to its workforce’s interests.

as the tech giant continues to navigate regulatory scrutiny and market fluctuations, this strategic buyback may serve as a critical component in maintaining its enterprising growth trajectory.

Implications for Employee Morale and Talent Retention at ByteDance

The decision by ByteDance to buy back employee shares at a critically important valuation is poised to have profound implications for staff morale and talent retention.This move will likely be interpreted as a signal of financial stability and a commitment to its workforce. Employees often gauge the health of a company based on how it values their contributions; offering to buy back shares can foster an environment of trust and thankfulness. Key effects may include:

- Boosted Confidence: Employees may feel more secure in their positions, knowing the company is acknowledging their worth financially.

- Enhanced Loyalty: A buyback initiative can cultivate a sense of loyalty among staff, encouraging them to invest their careers in the company for the long term.

- Improved Workplace Culture: Positive sentiment can permeate the organizational culture, leading to higher levels of engagement and collaboration.

Moreover, talent retention could see notable improvements as well. High-caliber professionals are often attracted to organizations that demonstrate growth and appreciation for their employees.The buyback can act as a competitive edge in the tech industry, where skilled workers are in high demand. This could lead to:

- Lower Turnover Rates: employees who feel valued are less likely to seek opportunities elsewhere, reducing recruitment and training costs for ByteDance.

- Attraction of Top Talent: The potential for financial rewards, combined with a robust company reputation, may help in attracting skilled new hires.

- Strengthened Employee Brand: A positive employer brand can emerge from such initiatives, further positioning ByteDance as an employer of choice in the tech sector.

Analyzing the Market Impact of ByteDance’s Buyback Strategy

ByteDance’s recent proclamation to initiate a share buyback program for its US staff has sent ripples through the market, signaling a strategic shift that may define the company’s financial narrative in the coming years. With a staggering valuation of $312 billion, this move underscores the tech giant’s commitment to its workforce while also reflecting confidence in its long-term growth prospects. Analysts are keenly assessing the potential repercussions on employee morale, investor sentiments, and overall market positioning. The buyback strategy could help improve stock liquidity, reduce market volatility, and provide a buffer against potential stock price fluctuations influenced by external factors.

Market experts are analyzing several key aspects of this buyback initiative, including:

- Employee Retention: By repurchasing shares, ByteDance not only rewards its employees but also strengthens their loyalty and commitment to the company.

- Investor Confidence: Such a substantial buyback might lead to increased confidence among existing investors and attract new ones, viewing it as a sign of financial health.

- Market Dynamics: The move could lead to a reduction in the overall share supply, potentially boosting the share prices, making it an intriguing factor for market analysts.

Recommendations for Investors in Light of ByteDance’s Recent Developments

The recent announcement from ByteDance about its decision to buy back U.S. staff shares at a staggering $312 billion valuation has potentially significant implications for investors. This move not only reflects the company’s robust confidence in its growth trajectory but also highlights its commitment to retaining top talent in a competitive market. Investors should closely monitor how this buyback affects the company’s financials and employee morale, as these factors will be integral to ByteDance’s long-term stability and expansion.

Furthermore, with the valuation now set at such a lofty benchmark, it becomes essential for investors to consider a few key strategies moving forward:

- Assess Market Sentiment: Keep a pulse on investor sentiment and employee responses following the buyback announcement to gauge future performance.

- Diversify Investments: Given the volatility associated with tech stocks, diversifying portfolios can mitigate risks while still capitalizing on growth opportunities.

- Monitor Regulatory Developments: Stay informed about any regulatory changes in the tech landscape, which could influence ByteDance’s operations and valuation.