The Rising Tides of Chinese Tech Stocks and the Looming Correction

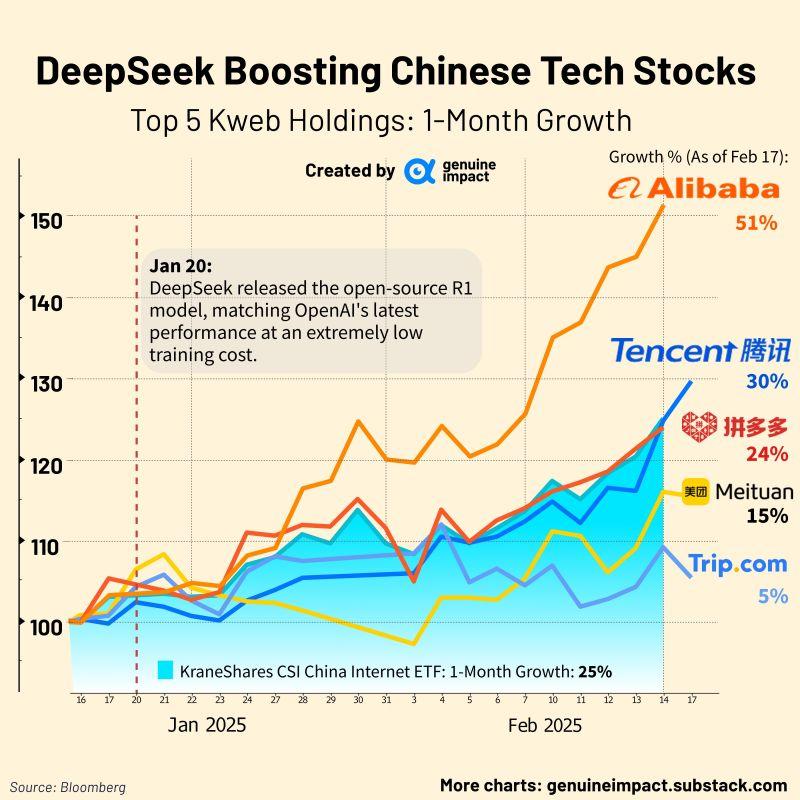

The recent rally in Chinese tech stocks has drawn the attention of investors worldwide, with optimism surging amid strong quarterly earnings reports and strategic government policies aimed at revitalizing the sector. Companies like Alibaba and Tencent have seen their stock prices rebound significantly, igniting a sense of confidence that the worst of the regulatory crackdown might potentially be behind them. The landscape appears to be buoyed by several factors:

- Government Support: Policymakers have indicated a more favorable regulatory environment, positioning tech companies for growth.

- Global Demand: As international markets rebound, the appetite for chinese technology products and services is increasing.

- innovation Drive: Major players are heavily investing in AI and cloud technologies, ensuring they remain competitive in the global arena.

However, this newfound optimism could rapidly shift as market indicators point to a possible correction on the horizon. Analysts are beginning to voice concerns over inflated valuations and an overall market sentiment that could sour just as quickly as it has improved. Factors contributing to this sentiment shift include:

- Valuation Concerns: Many stocks are trading at levels that suggest overextension, leading to potential pressure.

- Geopolitical Tensions: Increasing tensions between China and Western nations may influence investor confidence and buy patterns.

- Market Volatility: The recent spike in stocks frequently enough precedes corrections, with many investors eyeing an exit strategy.

understanding the Factors Behind the Sentiment shift in the Market

The recent turnaround in the market sentiment surrounding Chinese tech stocks has caught many investors off guard. After a prolonged period of optimism fueled by regulatory easing and strong earnings reports, a confluence of factors has now cast a shadow over this sector. Some of the primary contributors to this shift include:

- Geopolitical Tensions: Escalating tensions between China and the US, notably surrounding trade and technology issues, have raised fears about future profitability and market access for these companies.

- Regulatory Concerns: Despite earlier signs of a regulatory thaw, recent government actions hint at a return to stricter oversight, which has made investors wary about the sustainability of previous growth metrics.

- Market Overvaluation: Analysts suggest that the sharp rise in stock prices may have created a bubble, leading to profit-taking behavior among investors looking to mitigate risk.

As these elements intertwine, market participants are reevaluating their positions, causing a pronounced shift in sentiment. Additionally, macroeconomic indicators—such as slowing GDP growth and rising consumer prices—are further dampening investor confidence. The fear of a potential correction emerges not onyl from these immediate concerns but also from a broader apprehension about global economic stability.In an environment where uncertainty prevails, the future of Chinese tech stocks hangs in the balance, prompting investors to adopt a more cautious stance as they navigate the complexities of the market landscape.

Investment Strategies to Navigate Potential Volatility in Tech Stocks

As the tech sector faces potential turbulence, particularly in the realm of Chinese stocks, investors must adopt a proactive and strategic approach to safeguard their portfolios. Implementing diversification is crucial; by spreading investments across various tech segments, including hardware, software, and Internet services, investors can mitigate risks associated with market volatility. Additionally, considering ETF investments that focus on tech sectors can provide exposure while balancing the inherent risks tied to individual stocks.

Another effective strategy involves a focus on long-term fundamentals. Despite short-term fluctuations, companies with strong financials, innovative technologies, and considerable market positioning are more likely to withstand market corrections. Investors should prioritize companies with solid cash flow,sustainable business models,and clear pathways to growth. Moreover, keeping an eye on emerging trends, such as artificial intelligence and renewable energy technologies, can offer opportunities for long-term gains. Regularly reviewing and adjusting one’s investment thesis in response to changing market sentiments will be essential in navigating this challenging landscape.

Long-Term Perspectives on the Recovery Potential of chinese Technology Sector

The fluctuations in investor sentiment surrounding Chinese technology stocks have become a focal point for analysts and stakeholders alike, particularly as the sector appears to be approaching a critical juncture. Many factors contribute to this landscape, with regulatory pressures and geopolitical tensions being at the forefront. yet, underlying these challenges are resilient trends that could facilitate recovery over the long term. Proponents of the sector argue that the innovation pipeline remains robust, highlighting key areas such as:

- Artificial Intelligence (AI) – Notable advancements in AI technologies are expected to drive efficiency and productivity across multiple industries.

- 5G expansion – The ongoing rollout of 5G infrastructure is anticipated to propel growth in connected devices and smart technologies.

- Green Technology – Investments in sustainable practices and renewable energy solutions could position chinese tech companies as leaders in the global transition to eco-pleasant technology.

As the market grapples with a potential correction, the long-term viewpoint reveals a sector poised for robustness amid adversity. The ability of Chinese tech companies to adapt to regulatory changes and capitalize on emerging global trends may ultimately enhance their competitive edge.Moreover, foreign investment sentiment may shift positively if companies demonstrate resilience, fostering an environment where long-term strategic planning can take precedence. In this context, several key indicators will play a pivotal role in assessing the recovery potential of the sector, including:

- Market Demand – Continued growth in consumer demand for technology products will be crucial.

- Regulatory Clarity – A more transparent regulatory framework could instill confidence among investors.

- Strategic Partnerships - Collaborations with global players may enhance innovation capabilities and market reach.