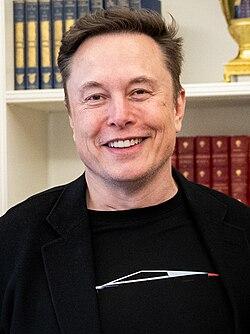

Elon Musk’s Strategic Investment Signals Confidence in Tesla’s Future

In a bold move reflecting his unwavering belief in tesla’s potential, Elon Musk has recently acquired $1 billion worth of Tesla stock, a transaction that has sent ripples through the financial markets and renewed investor optimism. This notable investment not only reaffirms Musk’s confidence but also serves as a strategic signal to both shareholders and the automotive industry at large. By personally injecting capital into the company, Musk is betting on the long-term sustainability and growth trajectory of Tesla, underscoring the critical role the electric vehicle maker plays in the transition to lasting energy.

Market analysts suggest that such a large-scale purchase can herald numerous positive implications:

- Increased Investor Confidence: Musk’s investment may encourage other investors to consider buying into Tesla, propelling stock values upward.

- Reinforced Commitment: This move may reassure employees and consumers that Tesla is on a solid path forward despite market volatility.

- Future Innovation: The additional capital could bolster Tesla’s initiatives in developing cutting-edge technology and expanding their product lineup.

As stakeholders watch with keen interest, Musk’s decisive action could play a pivotal role in shaping Tesla’s narrative, reinforcing its position as a leader in the fast-evolving automotive sector.

market Reactions: How Musk’s Billion-Dollar Bet Influences Investor sentiment

The purchase of $1 billion in Tesla shares by Elon Musk has sent ripples through financial markets, igniting a renewed fervor among investors and reshaping sentiment around the automaker’s prospects. As the billionaire’s faith in his own company becomes apparent, reactions have been swift and telling.Analysts and investors are closely re-evaluating their positions, with many viewing Musk’s bold move as a signal of confidence in Tesla’s growth trajectory. This occurrence has fostered a wave of optimism that could potentially translate into increased demand for Tesla stock. Some of the immediate effects include:

- increased trading Volume: A surge in buying activity has been noted, as investors rush to capitalize on the perceived validation of Tesla’s market position.

- Positive Media Buzz: News outlets are amplifying this growth, which can definitely help bolster public perception and may attract new investors.

- Market Rally: Following the announcement, Tesla shares experienced immediate gains, setting off a rally that influenced broader tech stock movements.

However, the impacts of Musk’s investment extend beyond mere stock fluctuations. The billionaire’s latest financial commitment prompts a critical self-reflection among institutional investors, who may find themselves reassessing their strategies in light of Musk’s aggressive stance. Indeed,the move solidifies the notion that the CEO remains at the helm of the company’s narrative,with potential implications for both corporate governance and long-term strategy. Key factors influencing investor sentiment post-acquisition include:

- Long-Term Vision: Musk’s apparent commitment could incentivize investors to adopt a longer perspective on Tesla’s growth plans.

- Heightened Competition: In an ever-changing EV landscape, Musk’s actions could spur rival firms to react more assertively.

- Investor loyalty: The stock buyback showcases Musk’s confidence, possibly strengthening investor loyalty amidst market volatility.

Evaluating the Implications for Tesla’s Stock Performance and Growth Trajectory

Elon Musk’s recent acquisition of $1 billion in Tesla stock is a significant move that could ripple through the markets and provide strong indications about the company’s future. By investing such a ample amount, Musk is not only showcasing his confidence in Tesla, but he is also potentially signaling to investors that the stock is undervalued. This bodes well for investor sentiment, likely leading to increased buying activity as shareholders interpret Musk’s actions as a vote of confidence in the company’s long-term strategies and prospects.

The implications for Tesla’s stock performance can be profound and multifaceted. Analysts are now examining key factors such as:

- Market Confidence: A bullish sentiment may emerge, attracting new investors and stabilizing stock fluctuations.

- Growth Trajectory: This move might suggest a forthcoming surge in production capacity or innovative projects that could drive future earnings.

- Shareholder Relations: musk’s personal investment could help align interests and build trust with shareholders, enhancing long-term loyalty.

Moreover, Tesla’s position as a leader in electric vehicle technology may firm up, increasing its competitive edge and encouraging potential partnerships or expansions in renewable energy initiatives. With Musk’s backing, analysts predict a potential upside in both market performance and leverage for growth opportunities in the coming quarter.

Expert Insights: What Analysts Recommend for Stakeholders Following Musk’s Purchase

In light of Elon Musk’s recent acquisition of $1 billion worth of Tesla stock, financial analysts are urging stakeholders to adopt a strategic approach as they navigate the shifting dynamics within the automotive and tech markets. Following this significant investment, experts recommend that investors closely monitor the following key indicators:

- Market Sentiment: Pay attention to consumer sentiment and demand fluctuations for electric vehicles, as these metrics will directly impact Tesla’s future profitability.

- Production Capacity: Assess any updates on Tesla’s production capabilities, especially in relation to new factories and technology upgrades that could enhance output.

- Regulatory Changes: Be aware of evolving regulations surrounding electric vehicles and energy policies, which could influence tesla’s market position.

- Competitive Landscape: Watch competitors’ movements in the EV space, as their innovations and pricing strategies may affect Tesla’s market share.

Additionally, analysts advise stakeholders to maintain a diversified portfolio while understanding the cyclical nature of the stock market. As Musk’s acquisition reinforces his confidence in Tesla, it’s crucial to be wary of potential volatility in the stock price. Practicing prudent risk management will be essential, especially considering the historic fluctuations in Tesla’s stock value. Stakeholders should evaluate their investment horizons and ensure their strategies are aligned with both the current economic climate and long-term growth potential.