N26 Considers Strategic Funding Round Amid Market Dynamics

As Germany’s fintech landscape evolves, N26 is exploring a strategic funding round that could reshape its financial trajectory amidst shifting market dynamics. With the pressure of rising interest rates and changing consumer behaviors, the digital banking pioneer is considering options that not only bolster its capital base but also accommodate a partial exit for early investors. This scenario suggests a dual approach to financing that aims to attract new investors while providing an avenue for existing stakeholders to realize some of their gains.

The potential funding round reflects broader trends within the financial technology sector, where companies are consistently recalibrating their strategies to maintain competitiveness. Industry insiders have pointed out several key factors influencing N26’s decision-making process:

- Market Volatility: Increased competition and economic uncertainty are prompting a reevaluation of growth strategies.

- Investor Sentiment: With recent shifts in the venture capital surroundings, securing favorable terms for new investment is paramount.

- Regulatory Changes: Navigating new compliance requirements adds complexity to operational expansion plans.

Ultimately, N26’s strategic funding considerations not only signal its resilience but also illustrate a proactive stance in adapting to market pressures, positioning itself for sustainable growth in an increasingly complex financial ecosystem.

exploring the Implications of a Partial Exit for Investors

The potential for a partial exit in N26’s upcoming funding round raises critically important considerations for investors. By allowing early stakeholders to sell a portion of their equity stake, the fintech company opens the door for a new mix of capital sources and operational versatility. This model shifts the risk profile for existing investors, enabling them to realize returns while still maintaining a foothold in a rapidly evolving market. This balancing act may attract a wider range of investors, who see the appeal of both liquidity and long-term growth potential.

However, this strategic maneuver also invites scrutiny regarding the long-term valuation of N26. Investors must weigh several factors, including:

- The impact on share price as early investors exit and new ones enter.

- Market sentiment concerning the stability and future prospects of the company.

- Regulatory implications that may arise from such a partial exit.

Considering these dynamics will be essential for investors looking to navigate this complex terrain while positioning themselves for sustainable returns in the fast-paced fintech landscape.

Assessing N26’s Growth Trajectory and Future Prospects

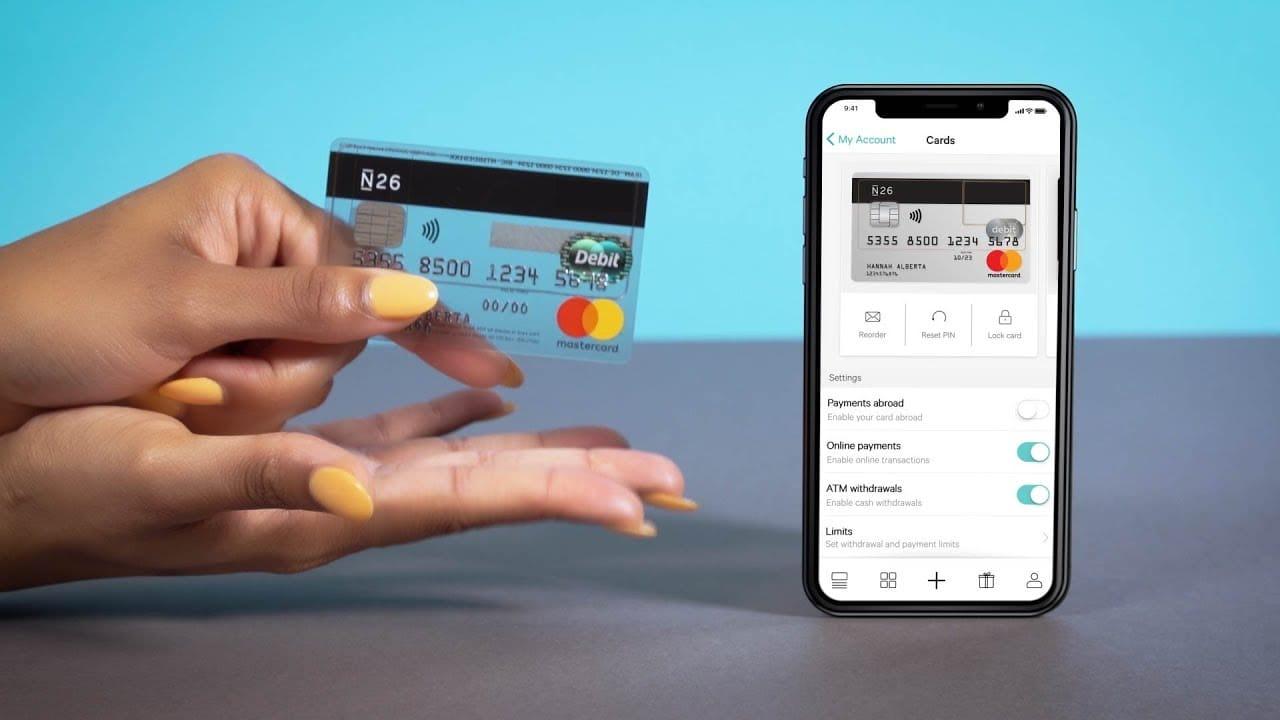

As N26 positions itself for a potential new funding round,industry analysts are keenly evaluating the fintech’s growth trajectory and broader implications for the digital banking landscape. Over the past few years, N26 has carved out a significant niche in the European market, attracting millions of customers with its streamlined banking solutions and user-amiable mobile interface. Key drivers of its expansion include:

- Innovative Features: Continuous upgrades to its app,enabling a seamless banking experience.

- International Expansion: Successfully entering new markets beyond Germany, such as the U.S. and parts of Europe.

- Strategic Partnerships: Collaborations with fintech firms that enhance service offerings and customer engagement.

Looking ahead, N26’s potential funding round may not only provide necessary capital for further growth but could also mark a pivotal moment in its evolution. With whispers of allowing early investors a partial exit, the move could attract fresh capital while simultaneously fostering confidence in its long-term vision. Factors shaping N26’s future include:

- Regulatory Challenges: Navigating the complexities of banking regulations across different jurisdictions.

- Competitive Landscape: Adjusting strategies in response to emerging challengers in the digital banking space.

- Technological Advancements: Leveraging AI and machine learning to enhance customer service and risk management.

Recommendations for Stakeholders in a Changing Financial Landscape

The evolving financial landscape necessitates a strategic approach from stakeholders aiming to navigate the complexities of funding and investment.as Germany’s N26 contemplates a new funding round that facilitates a partial exit, it is essential for stakeholders to understand market dynamics and adapt accordingly. Thay should focus on building robust financial models that effectively predict and respond to shifts in consumer behavior and regulatory environments. This requires an emphasis on data-driven decision-making and a thorough analysis of emerging trends in digital banking.

Moreover, establishing strong partnerships can considerably enhance resilience against market fluctuations. Stakeholders are encouraged to engage in collaborative ventures that leverage technology and innovation. Key recommendations include:

- Diversifying investment portfolios to spread risk across various sectors and minimize exposure to any single market downturn.

- Investing in customer engagement tools to foster loyalty and adapt services to the increasing demand for personalized banking solutions.

- Continuous monitoring of competitors and market disruptors to stay ahead of the curve and identify potential opportunities for growth.

Adopting these strategies will empower stakeholders to not only withstand the challenges posed by a shifting financial environment but also to capitalize on new opportunities effectively.