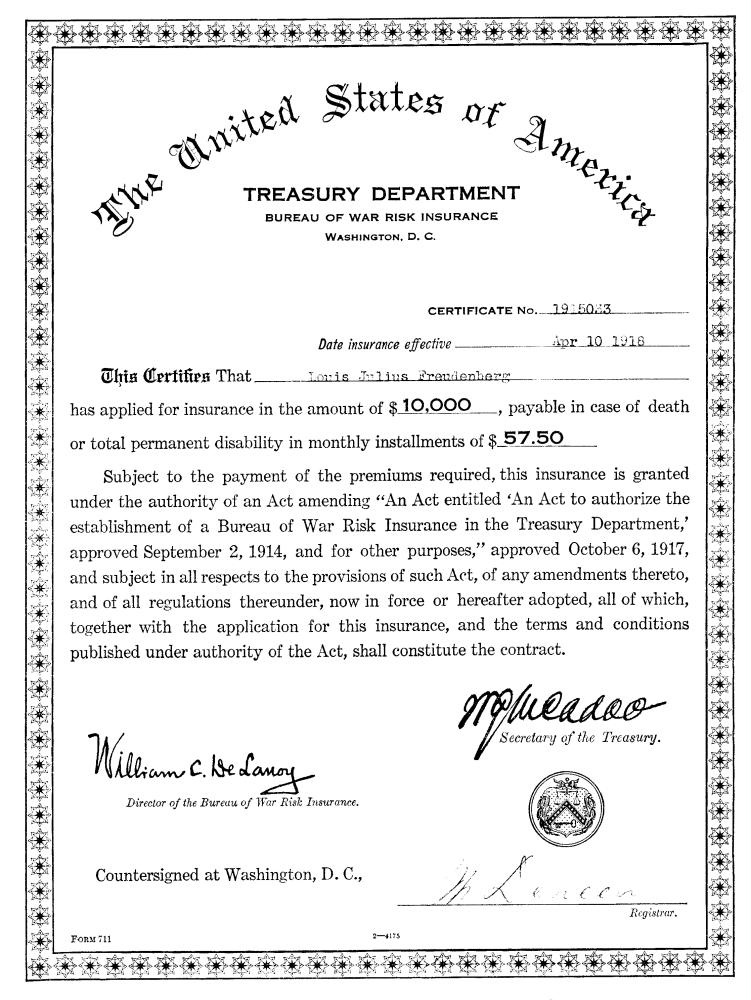

Understanding the Surge in War Risk Insurance Amid Global Tensions

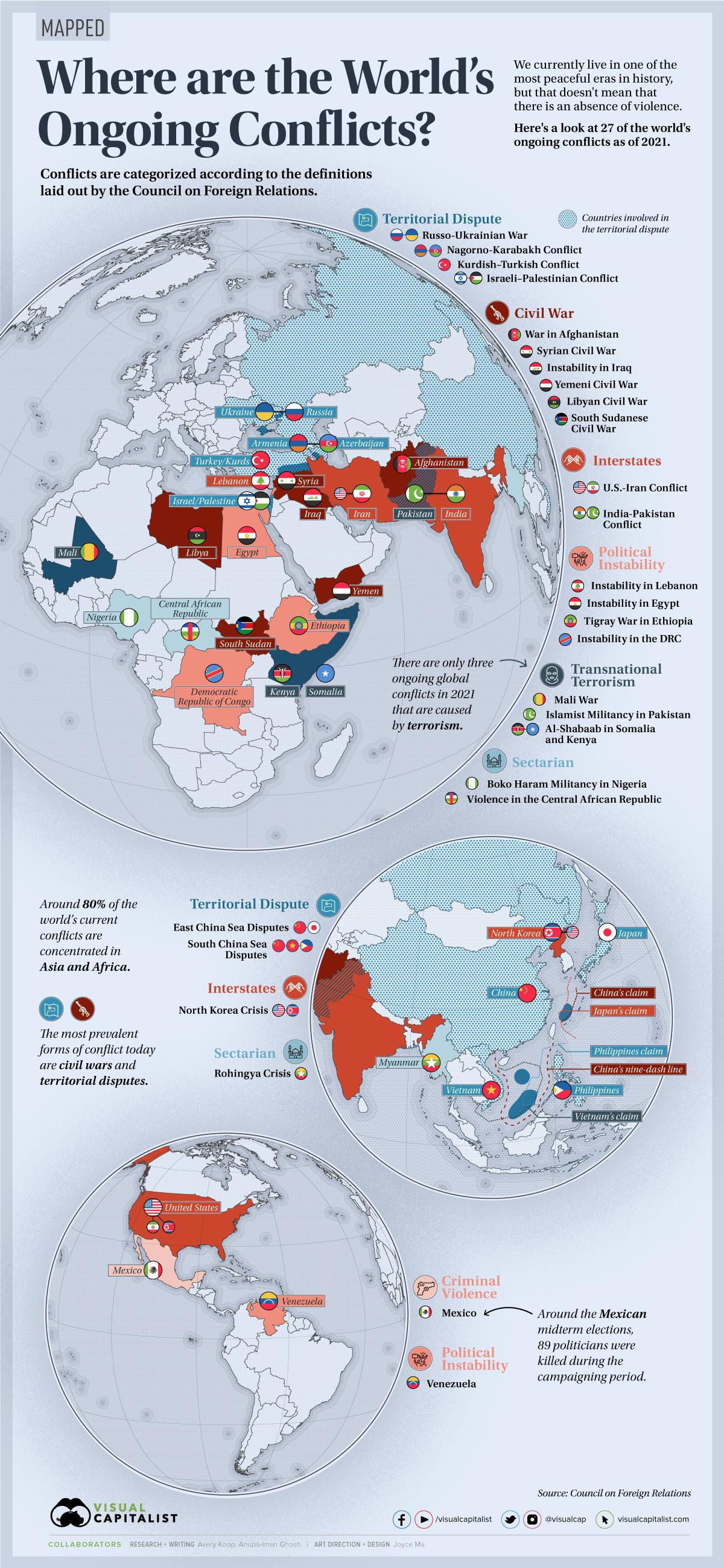

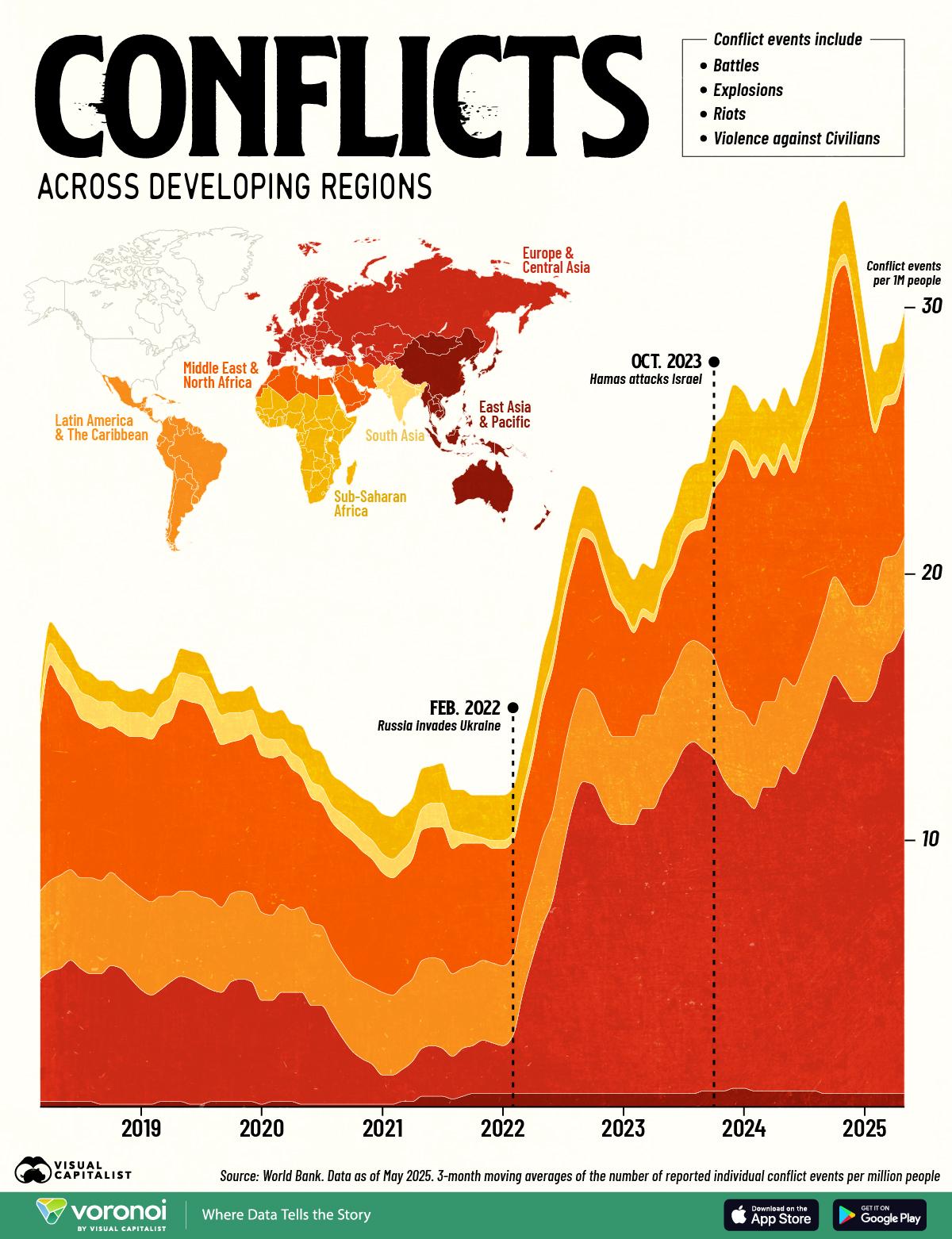

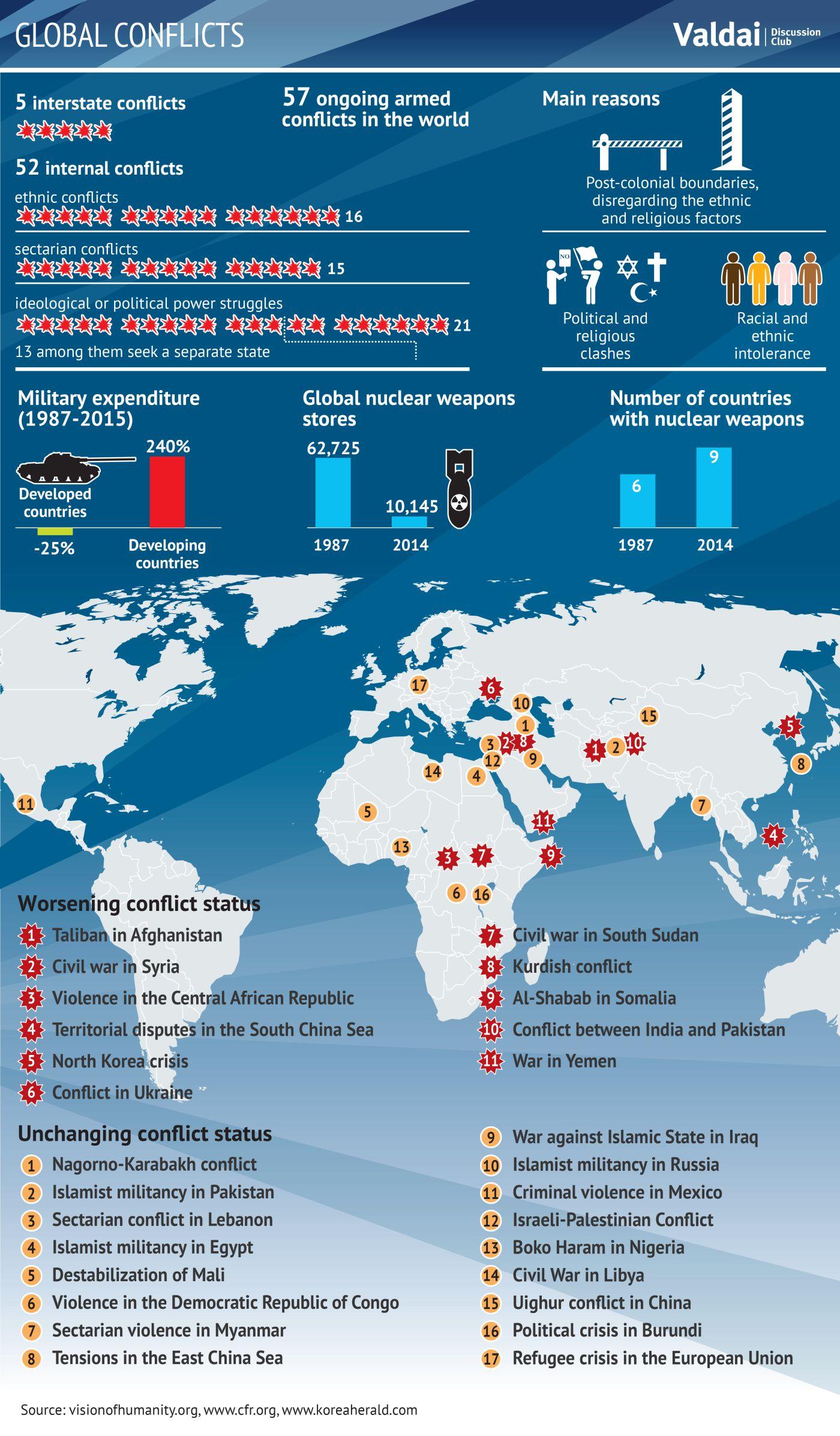

The ongoing geopolitical disputes and heightened military activities around the world have substantially increased the demand for war risk insurance. With regions such as Eastern Europe, the Middle East, and parts of Asia witnessing intensified conflicts, businesses and maritime operators are taking extra precautions to safeguard their assets. The surge in demand is primarily fueled by the necessity to mitigate financial losses stemming from potential damage or destruction due to warfare, terrorism, or civil disturbances. This form of insurance not only protects physical property but also extends to cover liabilities that may arise in such volatile environments.

Several factors have contributed to the growing market for war risk insurance, including:

- Escalating geopolitical tensions: nations facing internal strife or external conflicts require heightened protection.

- Increased global trade routes: As commerce expands to less stable regions, the risk of disruption becomes apparent.

- Insurers adapting policies: Companies are now offering tailored solutions to meet the specific risks associated with war zones.

As businesses navigate this precarious landscape, the role of war risk insurance becomes increasingly crucial. It acts not only as a buffer against financial jeopardy but also underscores the importance of preparedness in an unpredictable global climate.

Analyzing Key conflict regions and Their Impact on Insurance Markets

As geopolitical tensions escalate around the globe, the demand for war risk insurance is being driven by conflicts that not only threaten regional stability but also significantly impact international trade and investment. Regions such as Eastern Europe, the Middle East, and parts of Africa have witnessed heightened military activities and civil unrest, prompting businesses operating in these areas to reassess their risk exposure. insurers are responding by refining risk assessment models to accommodate the dynamic nature of these regions, allowing them to offer tailored coverage that adequately protects assets against the backdrop of uncertainty.

The implications of these conflicts extend beyond the immediate danger to personnel and property; they reverberate through the broader financial landscape. Key factors influencing the war risk insurance market include:

- Increased Operational Costs: Insurers are adjusting premiums based on the rising costs associated with high-risk areas.

- Regulatory Changes: Governments may impose stricter compliance measures,affecting how businesses can operate in conflict zones.

- Market Perceptions: A growing perception of instability can erode investor confidence, translating into reduced economic activity.

These elements create a complex environment where insurers must navigate both the immediate risks posed by conflict and the overarching economic consequences of their management strategies. As the landscape continues to evolve, businesses must remain vigilant and proactive in securing the necessary coverage to mitigate potential losses.

Evaluating the Benefits and Limitations of War Risk Coverage for Businesses

Buisness owners are increasingly recognizing the meaning of war risk insurance as geopolitical tensions escalate globally. This specialized coverage can offer critical financial protection against losses incurred from acts of war,terrorism,and civil disturbances,which are becoming more prevalent in many regions. benefits of war risk coverage may include:

- Financial Security: Safeguards businesses from substantial losses that could jeopardize their operations.

- Enhanced Credibility: Shows stakeholders and clients that the business is prepared for unexpected disruptions.

- Global Reach: Enables companies to engage in international markets with greater confidence, knowing they have a safety net.

Though, the potential limitations of war risk insurance deserve careful consideration.Many policies may have exclusions or stipulations, such as denying coverage for certain types of warfare or geographical regions deemed too risky. Additionally, the costs associated with obtaining such coverage can be considerable, especially for smaller businesses with tighter budgets.other challenges include:

- Complexity of Claims: Navigating the claims process can be convoluted and time-consuming.

- Policy Variability: differences in coverage terms can lead to confusion and may leave businesses vulnerable in critical moments.

- Market Availability: Depending on the region, war risk coverage might not be readily accessible, further complicating risk management strategies.

Strategic Recommendations for navigating War Risk Insurance in a Turbulent World

In the face of escalating global tensions,organizations must prioritize understanding the intricacies of war risk insurance. A tailored approach is essential for businesses venturing into high-risk areas. Stakeholders should consider the following actions:

- Conduct Thorough Risk Assessments: Engage with risk management professionals to evaluate potential exposure based on current geopolitical climates.

- stay Informed on Global Developments: Regularly monitor news and analysis from reliable sources to anticipate changes that may impact humanitarian operations or supply chains.

- Build Flexible Insurance Policies: Negotiate coverage that adapts to the dynamic nature of conflict zones, ensuring that terms can be adjusted as risk levels evolve.

- Engage with Experts: Partner with insurance brokers who specialize in war risk to navigate complexities and secure the most appropriate coverage.

Additionally, fostering a culture of preparedness within your organization can mitigate the repercussions of conflict-related incidents. implementing strategies such as:

- Training and Awareness Programs: invest in training for employees regarding safety protocols in volatile regions.

- Creating Contingency Plans: Develop and regularly update emergency response plans to handle unexpected situations effectively.

- Establishing Interaction Networks: Ensure reliable lines of communication for real-time updates, which can be critical during a crisis.

Addressing these components comprehensively will equip businesses to better navigate the complexities tied to war risk insurance, ensuring resilience amid uncertainty.