Global Oil Prices Surge as Tensions Escalate in the Middle East

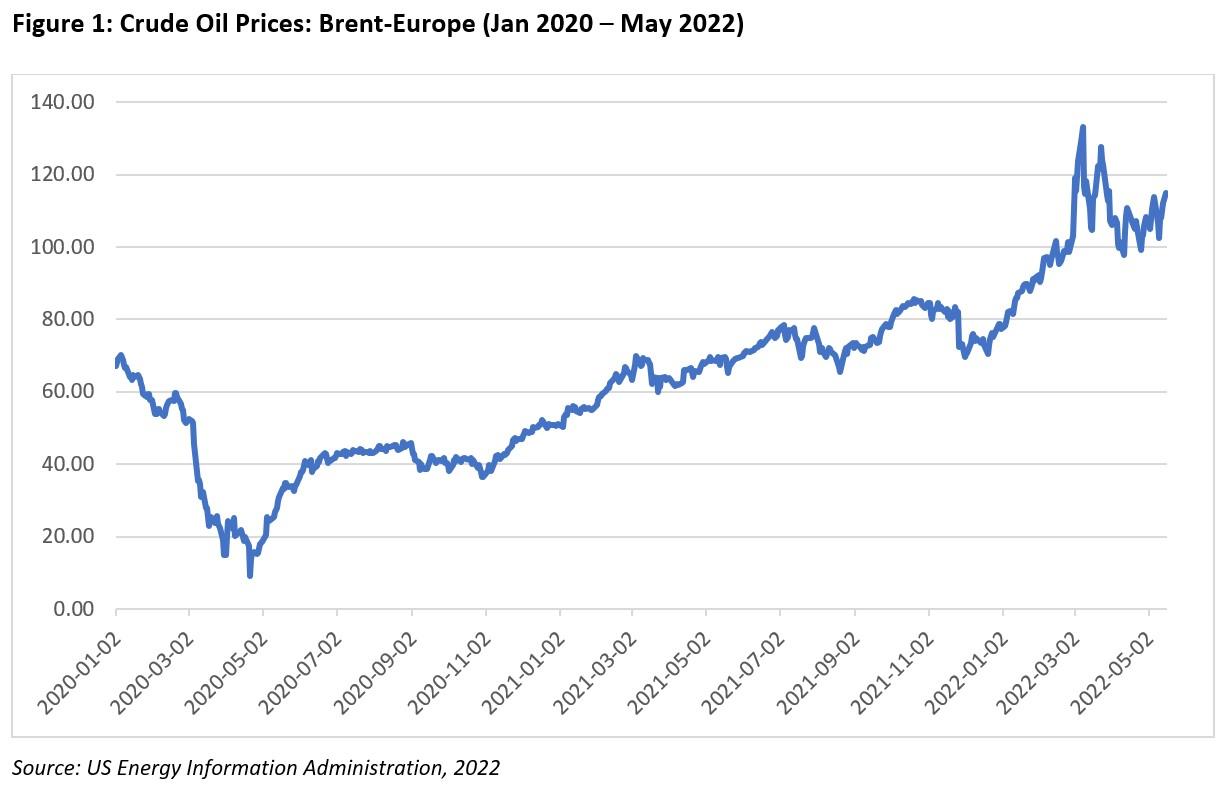

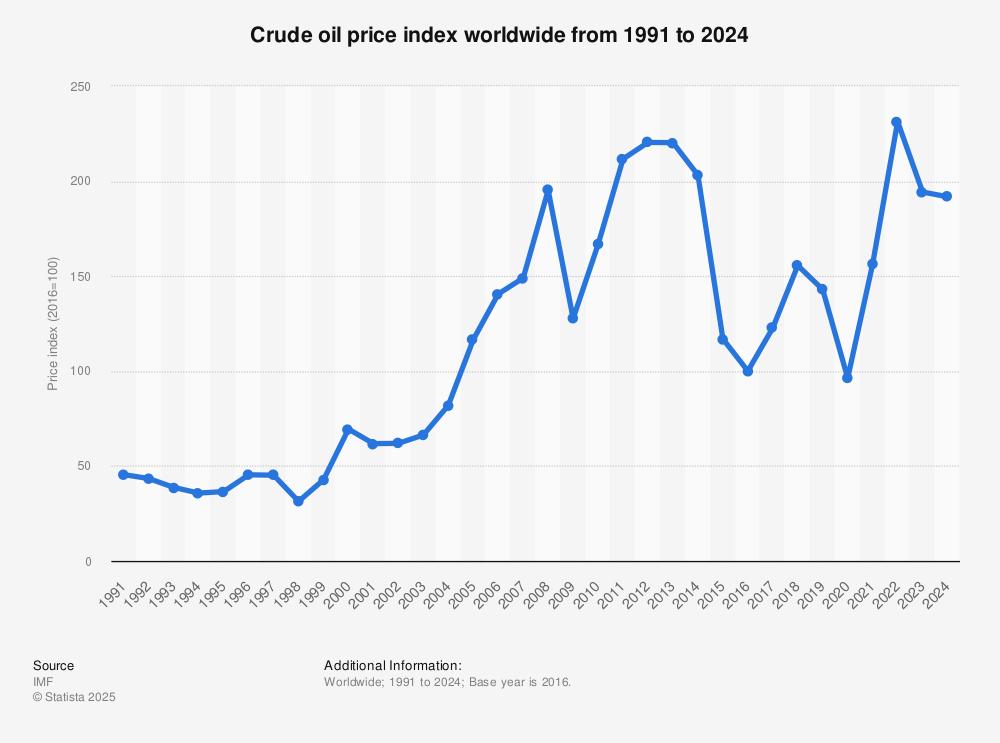

As tensions spike following Israel’s recent military action against Iran, global oil markets are experiencing unprecedented volatility.Reports indicate that crude oil prices have surged by over 10% in just a matter of days,reflecting investor fears surrounding potential supply disruptions in the already unstable Middle Eastern region. Key factors contributing to the price surge include:

- Geo-political Uncertainty: Escalating conflicts in the Middle East often lead to apprehensions about oil supply disruptions, causing traders to react swiftly to price movements.

- Production Risks: The possibility of retaliatory strikes or embargoes on oil exports from Iran and neighboring nations is raising alarms across international markets.

- Market Speculation: Many investors are flocking to oil futures amid fears that the situation could worsen, driving up prices even further.

This market reaction not only impacts oil-producing nations but also poses meaningful risks to global economies reliant on stable energy prices. Analysts predict that if hostilities continue or escalate, we could see a further increase in oil prices, straining budgets for consumers and businesses alike. Countries that depend on oil imports may face heightened inflation and potential energy shortages,deepening the economic challenges posed by current geopolitical strife.

Analyzing the Immediate Economic Impact on Major Oil Markets

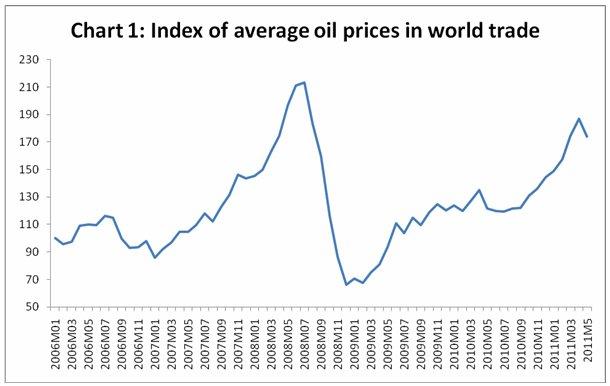

The recent escalation of tensions following Israel’s attack on Iran has led to a significant surge in global oil prices, reshaping the landscape of major oil markets. Analysts report that the immediate response from investors highlights a palpable sense of uncertainty surrounding supply stability in the region, especially as Iran is one of the world’s leading oil exporters. The repercussions are felt beyond regional borders, with global markets reacting swiftly to the news, creating a ripple affect that could influence oil prices worldwide.

Key factors contributing to the sharp increase in oil prices include:

- Supply Chain Disruptions: Transitory interruptions in production and distribution networks amplify concerns over oil availability, triggering a bullish trend in pricing.

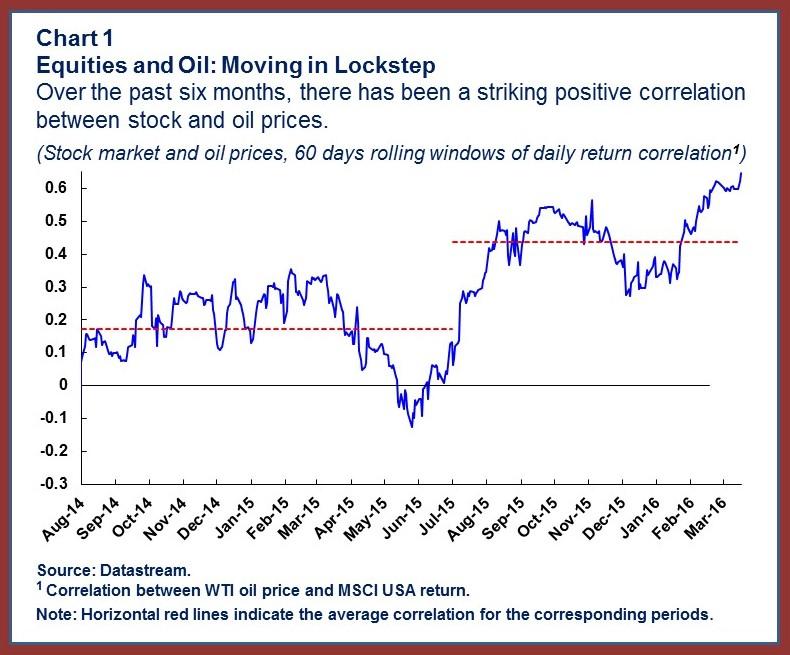

- Speculative trading: Futures contracts and options saw a surge in speculative buying as traders seek to capitalize on short-term volatility.

- Geopolitical Risk Premium: The rising tensions have added a layer of geopolitical risk,prompting oil traders to factor in potential escalations in conflict.

This swift, multifaceted reaction underscores the sensitive nature of oil markets to geopolitical events, and the repercussions of such actions may reverberate through the global economy as countries reassess their energy security strategies.

Strategic Responses: How Governments and Corporations Should Navigate the Crisis

The recent escalation in conflict following Israel’s attacks on Iran has sent ripple effects throughout the global economy, with oil prices surging to unprecedented levels.Governments must act swiftly and decisively, employing a combination of immediate and long-term strategies to mitigate the impact on their national economies. Key measures include:

- Enhancing diplomatic efforts to de-escalate tensions in the Middle East and ensure regional stability.

- Implementing price controls or subsidies on fuel to shield consumers from drastic price fluctuations.

- Diversifying energy sources by investing in renewable energy projects and fostering choice supply chains.

- Mobilizing emergency reserves to keep the supply stable while exploring negotiations with oil-producing nations.

For corporations, particularly those in energy-intensive industries, agility is paramount. Adapting to a shifting landscape requires a proactive approach that includes:

- Reevaluating supply chains to reduce reliance on unstable markets, promoting local sourcing were possible.

- Investing in technology to improve energy efficiency and reduce operational costs as oil prices climb.

- Strategic financial planning to weather volatile markets, such as hedging against potential price spikes.

- enhancing interaction strategies with stakeholders to maintain trust and transparency in uncertain times.

Looking Ahead: Forecasting Oil price Trends Amid Ongoing Geopolitical Uncertainty

As the dust settles from the recent escalation in the Middle East, analysts are turning their attention towards the future of global oil markets. The sudden uptick in prices is attributed not only to immediate supply fears but also to broader geopolitical dynamics. As countries recalibrate their energy strategies, several factors will likely play a crucial role in shaping the trajectory of crude oil prices in the coming months. Key considerations include:

- Supply Chain Vulnerabilities: With significant disruptions reported in oil transport routes, any flare-up in tensions could lead to further market volatility.

- OPEC’s Response: the organization’s ability to manage production levels amid rising prices will be critical; potential output increases may offer some relief.

- Global Economic Indicators: Market reactions will be closely tied to economic recovery signals, with demand pressures from key consumers like China and the U.S. influencing price stability.

Simultaneously, as nations grapple with internal demands for energy security, investments in alternative energy sources are likely to accelerate, creating a complex interplay with customary oil markets. Investors and consumers alike should brace for a landscape shaped by:

- Shifts in Policy Frameworks: Governments may implement strategic reserves or sanctions that can significantly alter supply dynamics.

- Technological Advancements: Innovations in extraction and renewable energy technologies could redefine long-term dependency on fossil fuels.

- Investor Sentiment: Heightened geopolitical risks often lead to speculative trading, influencing immediate pricing trends.