Navigating Trade Barriers: the Impact of Trump’s Tariffs on Climate Technology Supply Chains

The imposition of tariffs during Trump’s governance significantly altered the landscape for climate technology supply chains, introducing both challenges and opportunities for businesses operating within the sector. With substantial duties placed on imports, companies relying on international components faced increased costs and logistical hurdles that may hinder innovation and development. The key impacts include:

- Raised Costs: Manufacturers found themselves coping with elevated prices for essential materials and components, leading to potential higher prices for end consumers.

- Supply Chain Disruptions: Tariffs created uncertainty that exacerbated existing vulnerabilities, particularly for technology dependent on global supply chains, often involving critical elements sourced from overseas.

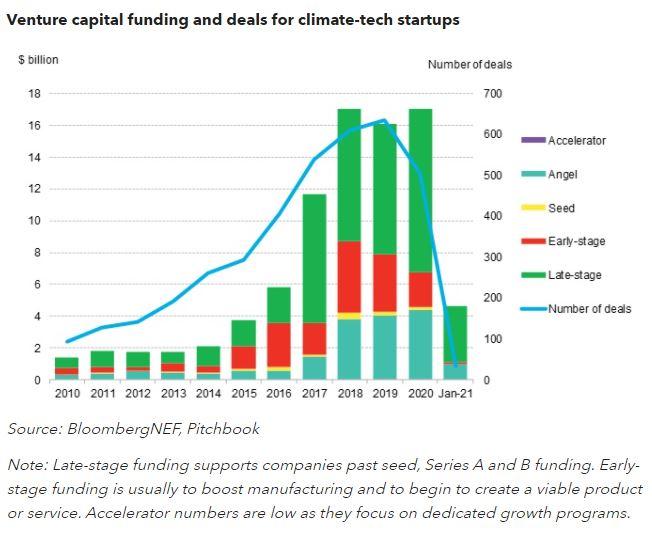

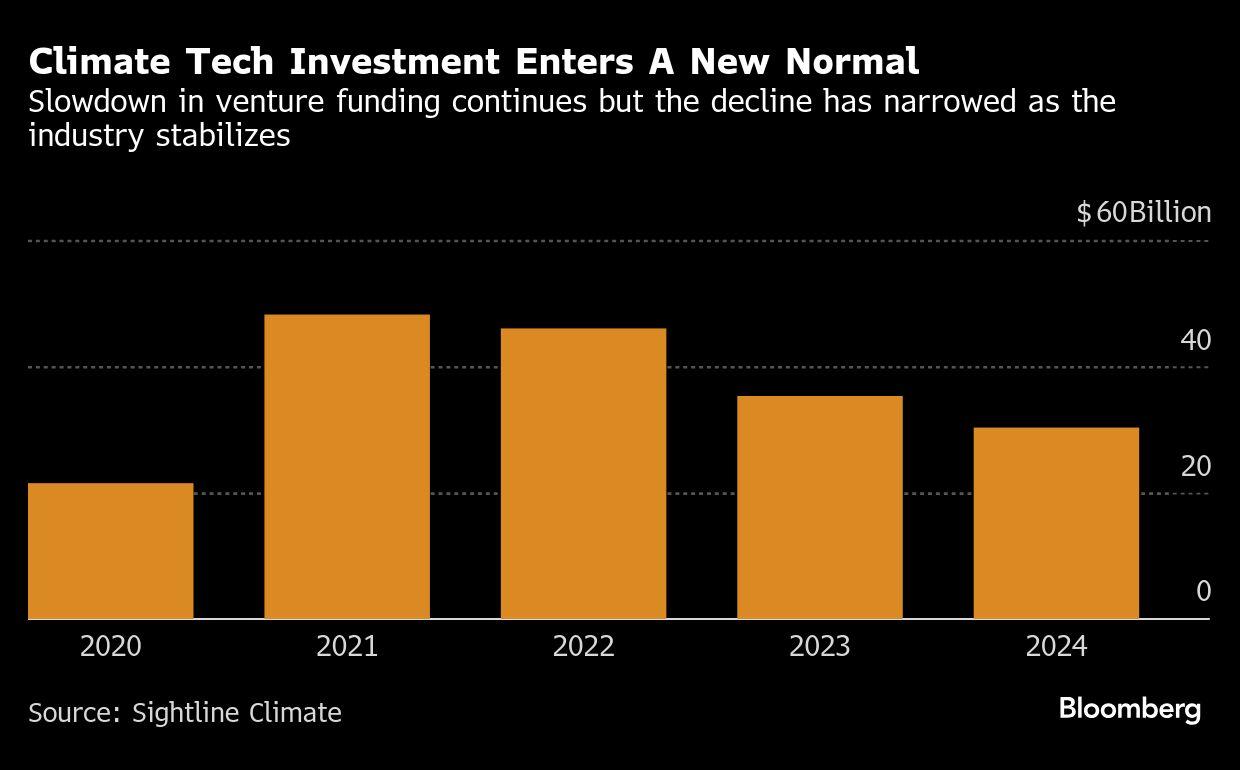

- Investment Shifts: Investors began to pivot their focus, scrutinizing supply chain resilience and domestic production capabilities more closely than before, potentially altering the funding landscape for emerging climate technologies.

Moreover, the trade policies enacted under Trump’s administration spurred some companies to explore domestic alternatives, fostering innovations closer to home that could meet national objectives for sustainability and independence from foreign supply chains.As businesses navigate these turbulent waters, they are prompted to rethink strategies, emphasizing local sourcing and bolstering U.S.-based manufacturing capabilities in an effort to mitigate future disruptions. This evolving dynamic raises questions of adaptability in the sector as old paradigms shift, leading to a potential renaissance in domestic climate technology production. The landscape may be fraught with challenges, yet it also opens new doors for strategic investment and innovation.

Regulatory Landscape Shifts: How Executive Orders Are Reshaping Investment Strategies in Climate Tech

In recent years, the regulatory environment surrounding climate technology has undergone significant transformations, largely influenced by executive orders and trade policies.These shifts are not just abstract legal changes; they have direct implications for how investors approach the burgeoning climate tech sector. Trump’s tariffs on imports, especially on solar panels and wind turbine components, have created a ripple effect that compels companies to reevaluate their supply chains, costs, and ultimately, their investment strategies. As domestic production becomes a necessity rather than a choice, there is an increasing focus on local innovation and supply chain resilience, steering funds toward startups and companies capable of delivering solutions within the U.S. borders.

Additionally, the push for regulatory alignment with sustainability goals has led investors to consider the long-term implications of compliance. With incentives for clean energy initiatives becoming a cornerstone of federal and state policies, investment strategies now reflect a dual focus on both profitability and environmental impact. Key considerations for investors include:

- Long-term viability of firms that align with evolving regulations.

- Adaptability of businesses to rapidly changing market conditions driven by policy shifts.

- Integration of technology that meets the new compliance standards and sustainability goals set forth by recent executive orders.

This evolving landscape requires investors to be more strategic, as they must balance immediate returns with the potential for future growth in a market shaped increasingly by governmental decisions.

Identifying Opportunities: Strategic Recommendations for Investors in an Evolving Market

In the current landscape, investors seeking to capitalize on climate tech must navigate a complex interplay of government policy, global trade dynamics, and technological advancements. Trump’s tariffs on imported goods—particularly on renewable energy components like solar panels and batteries—have created both challenges and opportunities. As domestic production faces higher costs due to these tariffs, savvy investors can identify potential gains in companies that are pivoting towards local manufacturing.Additionally, fostering partnerships with emerging tech firms focusing on innovative energy solutions can position investors at the forefront of this rapidly evolving sector.

The shift in policy has also opened doors to choice investment avenues. With a growing emphasis on enduring practices, investors should consider exploring:

- Companies utilizing recycled materials to produce energy-efficient technologies.

- Startups developing energy storage solutions that can mitigate the impact of tariffs on battery imports.

- Enterprises engaged in carbon capture technologies as demand for such innovations surges amid regulatory changes.

By strategically aligning with these emerging trends, investors can not only hedge against the adverse effects of tariffs but also contribute to a greener, more resilient future.

Future-Proofing Investments: Adapting to Policy Changes for Sustainable Growth in Climate Technology

As the climate technology sector evolves, investors are increasingly challenged to foresee the ripple effects of governmental policies, particularly considering Trump’s tariffs and executive orders. These measures have reshaped market dynamics,prompting a need for investors to recalibrate their strategies. with import tariffs on solar panels and batteries impacting profitability,companies in these spaces must adapt quickly or risk losing competitive advantage. In response to such shifting sands, the industry is leaning toward greater domestic production and innovation. Investors are now prioritizing projects that emphasize supply chain resilience and local manufacturing, recognizing the long-term sustainability that comes from reducing dependency on foreign materials.

Additionally, the changing regulatory landscape means that investors must stay informed about evolving environmental policies. The potential for new federal incentives aimed at promoting domestic clean energy production is a beacon for growth in the sector. Angling investments towards firms that embrace flexible operational models and are prepared to pivot in response to policy shifts can prove lucrative. Factors to consider include:

- Compliance with environmental regulations that may emerge or change in the coming years.

- The ability to pivot strategies quickly in reaction to tariff fluctuations.

- Commitment to innovation within clean technology to remain competitive and relevant.

By marrying investment strategies with an acute awareness of policy changes, stakeholders can secure positions in a resilient and thriving market.