Analyzing Bank Performance Amidst Market Volatility

The recent turmoil in the financial markets has ignited a wave of scrutiny over bank earnings, revealing a complex interplay between traditional banking practices and external pressures. Analysts are closely examining key performance metrics that indicate how banks are navigating the choppy waters of market volatility. Among the indicators under review are:

- Loan growth: Many banks are reporting steady loan demand, but questions remain about the sustainability of these figures amidst rising interest rates.

- Credit quality: With increasing defaults on certain loans, assessing the quality of bank portfolios is crucial in understanding potential risks.

- Net interest margins: Fluctuating interest rates can significantly impact profitability, making this a critical metric to watch.

The latest earnings reports reflect a divided landscape: while some institutions have demonstrated resilience through strategic risk management, others face challenges that could reshape their future. The landscape is further complicated by geopolitical tensions and changing consumer behavior, which are influencing investment strategies and lending practices. As banks adapt, the focus will likely shift towards innovation in financial services and the integration of technology to enhance operational efficiency and customer engagement.

Understanding Investor Sentiment Following Recent Earnings Reports

As investors sift through the aftermath of recent earnings reports, the landscape has become increasingly complex. Banks, in particular, have come under scrutiny following a wave of turmoil that sent shockwaves through the financial sector. The market’s reaction has been decidedly mixed, with some stocks rebounding sharply while others continue to struggle. Key indicators reflecting investor sentiment include:

- Earnings Misses: A number of institutions reported weaker-than-expected earnings, raising concerns about the broader economic climate.

- Guidance Adjustments: Many banks revised their future outlooks downward, which has created skepticism about their growth prospects.

- Market Volatility: Navigating unprecedented fluctuations in stock prices has led to heightened fear and uncertainty among investors.

These factors are contributing to a broader assessment of risk and opportunity within the banking sector. Analysts are closely monitoring trading volumes and options activity, which can provide insight into investor confidence and potential future movements. Furthermore, trends in consumer lending and deposits will be critical in shaping the narrative going forward. As the markets digest these reports, the prevailing mood among investors will likely hinge on how swiftly banks can stabilize their operations and restore trust.

Key Indicators to Watch in the Banking Sector

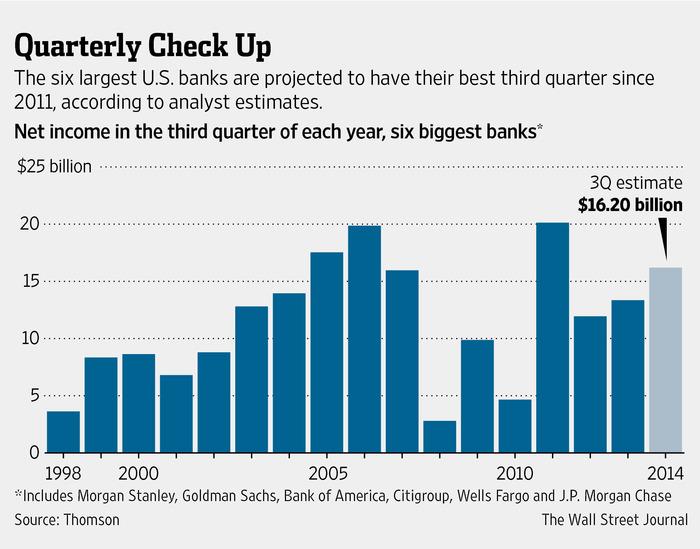

As investors navigate the aftermath of recent banking turmoil, several critical metrics are essential for gauging the health and stability of financial institutions. These indicators not only reflect the banks’ current performance but also signal potential future trends in the sector. Key metrics to scrutinize include:

- Net Interest Margin (NIM): This figure provides insight into the profitability of banks by measuring the difference between interest income generated and interest paid out to depositors.

- Loan-to-Deposit Ratio (LDR): A high ratio might indicate aggressive lending practices, which can be a risk factor during economic downturns.

- Non-Performing Loans (NPL): Tracking the percentage of loans that are in default helps assess the credit risk and overall asset quality.

- Capital Adequacy Ratio (CAR): This metric indicates a bank’s financial strength and ability to withstand operational losses, essential in times of market volatility.

In addition to these fundamental indicators, market analysts should keep an eye on broader economic signals that can affect bank performance, such as interest rate trends and regulatory changes. Understanding these elements can equip investors to make informed decisions about their banking sector exposures. Notably, attention to stock prices, dividend announcements, and consumer confidence indices will further enrich the analysis and provide a comprehensive view of what lies ahead for the banking landscape.

Strategic Moves for Investors in a Turbulent Financial Landscape

In light of the recent volatility, it’s essential for investors to recalibrate their strategies to align with the shifting market dynamics. Focus must be directed towards solid fundamentals, especially those companies that have demonstrated resilience during economic downturns. A few key considerations include:

- Diversifying Portfolios: Broaden exposure across various sectors to mitigate risks associated with potential downturns in specific industries.

- Identifying Value Stocks: Target undervalued companies with strong balance sheets and a history of stable earnings, especially those with potential for growth.

- Monitoring Economic Indicators: Keep a close eye on interest rates, inflation, and employment data, as these variables can significantly influence market behavior.

Moreover, investors should not shy away from alternative strategies that can offer protection and balance against market uncertainties. Incorporating hedging techniques or allocating a portion of the portfolio to defensive stocks can prove prudent. The following points warrant consideration:

- Exploring Fixed Incomes: Bonds and other fixed-income securities can provide stability amidst market turbulence, offering a steady stream of income.

- Utilizing ETFs and Index Funds: These can offer diversification at lower costs, allowing investors to spread their risk more efficiently.

- Staying Agile: Being open to rapidly adjusting investment theses in response to new data will be paramount in navigating these unpredictable waters.