Norways $1.8 Trillion fund Eyes Opportunities Amidst Tech Market Volatility

Teh CEO of Norway’s $1.8 trillion sovereign wealth fund has signaled a bold approach in the face of current tech market turbulence, suggesting that this could be a prime moment for contrarian investment. As tech stocks exhibit heightened volatility,the fund sees potential “attractive entries” for strategic investments. Observing market trends, the CEO pointed out that while many investors may shy away due to uncertainty, there are opportunities to capitalize on the fundamentals that remain strong in select tech companies, particularly those innovating in artificial intelligence and cloud computing.

In navigating this landscape,the fund aims to identify companies that not only weather the storm of economic fluctuations but also possess a robust long-term growth trajectory. Key factors that drive their investment decisions include:

- Market Positioning: Companies with a competitive edge in their respective sectors.

- Financial Health: strong balance sheets to withstand market pressures.

- Innovative Capabilities: Commitment to research and progress that promises future growth.

The fund’s approach underscores a willingness to embrace risk and target undervalued assets as a strategy to enhance returns over the long haul, setting it apart in an increasingly cautious investment climate.

The Rationale Behind a Contrarian Approach to US Technology Investments

The CEO of Norway’s $1.8 trillion sovereign wealth fund suggests that a contrarian approach to investing in US technology may be poised for a resurgence. This viewpoint arises from the understanding that market sentiment often sways in tandem with prevailing narratives, leading many investors to shy away from sectors perceived as volatile or overvalued. By embracing this viewpoint,the fund is setting itself apart by considering opportunities in companies that,despite facing short-term challenges,possess long-term potential driven by innovation. Key factors influencing this belief include:

- Market Cycles: The cyclical nature of technology stocks often leads to mispriced assets.

- Technological advancements: Ongoing developments in artificial intelligence, cloud computing, and other areas can provide important growth opportunities.

- Bargain Hunting: Current valuations may present attractive entry points for savvy investors willing to look past temporary turmoil.

- Global Positioning: Many US tech firms are global leaders, enabling them to weather domestic economic fluctuations.

In recent years, a plethora of market pessimism surrounding tech has obscured the underlying trends that favor innovation-led growth. The contrarian strategy hinges on recognizing that while negative sentiment might weigh on stock prices, it does not necessarily reflect the fundamental strength of the companies involved. This approach allows investors to navigate through the noise of short-term volatility and instead focus on the transformative capabilities of technology, which continue to redefine industries and consumer behaviors. The willingness to invest opposed to the prevailing market sentiment could yield significant rewards, drawing from a historical precedent where growth often follows periods of skepticism.

Analyzing Potential Risks and Rewards in the Current Tech Landscape

The CEO of Norway’s sovereign wealth fund, with its extraordinary $1.8 trillion portfolio, has outlined a compelling narrative for investing in U.S. technology. Despite recent volatility and skepticism surrounding the tech sector, he views the current climate as a unique opportunity to capitalize on a market that may be undervalued. This contrarian stance raises important considerations about the dynamics shaping technology investments today, which involve both potential rewards and inherent risks.

As investors weigh their options, several key factors emerge:

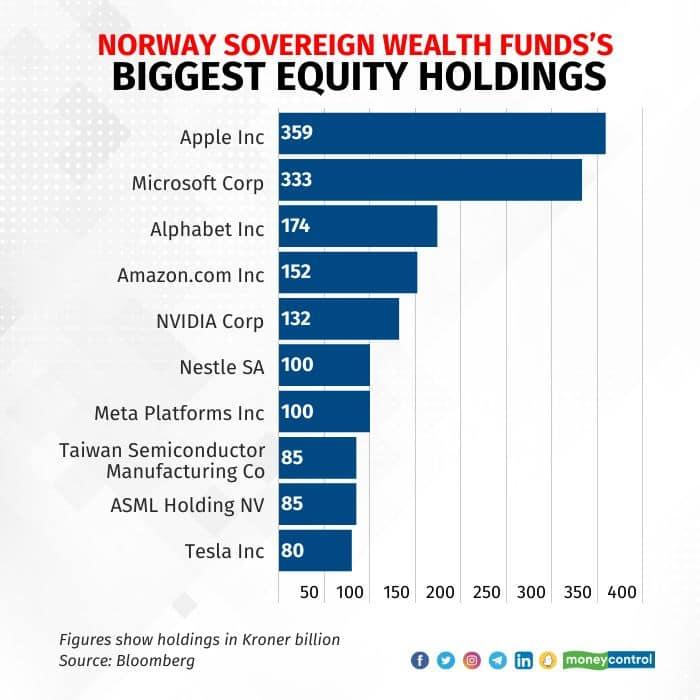

- Overreliance on Major Players: A heavy dependence on a handful of tech giants such as Apple and Amazon creates systemic risks that could destabilize the entire sector.

- regulatory Scrutiny: Increasing government oversight and antitrust actions may challenge the growth trajectories of many companies.

- Innovation Pressure: Rapid technological changes demand continuous innovation, and failure to keep pace can lead to obsolescence.

- Market Sentiment: The current bearish sentiments surrounding tech stocks could provide a buying opportunity for those with a long-term view.

Ultimately, discerning the balance between risk and reward in the tech landscape will require a nuanced understanding of these factors, as well as an ability to foresee how emerging trends could reshape the industry. As the CEO suggests, an investment in U.S. tech might not just be about chasing immediate gains but could also represent a strategic positioning for future growth amidst uncertainty.

Strategic Insights for Investors: Navigating the Future of Tech in America

The CEO of Norway’s $1.8 trillion sovereign wealth fund has recently shared insights that challenge conventional wisdom in tech investment.Emphasizing a contrarian approach, he highlights key indicators that suggest a ripe opportunity for investors willing to look beyond the prevailing pessimism in U.S. technology sectors. He articulates a belief that many high-performing tech stocks, frequently enough at the mercy of market trending, are being undervalued, creating a potential goldmine for discerning investors. This sentiment reflects a growing trend among savvy financial leaders who see untapped potential where others focus solely on caution.

among the reasons he cites for this optimistic view are:

- Resilience of Innovation: Despite short-term volatility, the foundations of tech innovation remain strong, with ongoing advancements in AI, quantum computing, and cybersecurity paving the way for robust growth.

- Diverse Investment Opportunities: From fintech to green technology, the changing landscape reveals a broad spectrum of sectors that are anticipated to thrive in the coming years.

- Global Market Dynamics: As international markets grapple with uncertainty, U.S. tech companies are well-positioned to capture market share, given their established infrastructure and leadership in cutting-edge technologies.