Samsungs Market Resilience: Analyzing the Impact of Nvidia Discussions

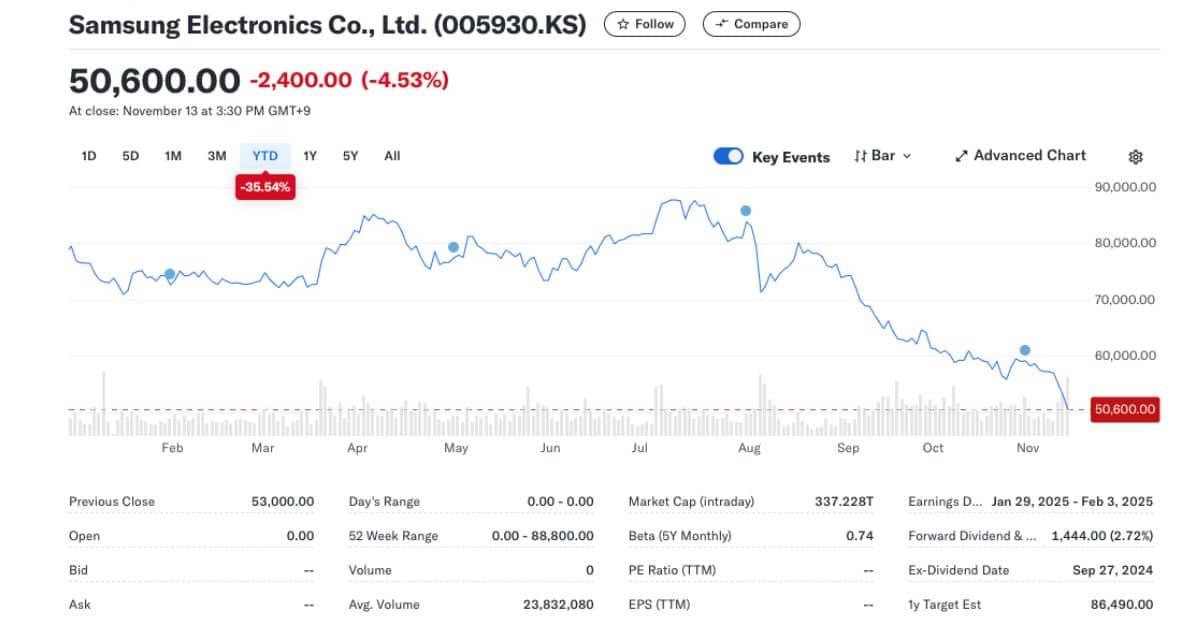

Samsung’s recent performance in the stock market has raised eyebrows, particularly considering discussions surrounding Nvidia. Analysts highlight that despite a disappointing profit report, Samsung’s shares have shown resilience, largely attributed to its strategic positioning in the semiconductor industry. The dialogue about Nvidia’s advancements has sparked renewed investor interest in Samsung, as the tech giant supplies critical components for the booming AI and gaming sectors. this dynamic emphasizes the interconnectedness within the technology ecosystem, where a single player like Nvidia can substantially influence market perception and, consequently, lead to stock recoveries for companies like Samsung.

The conversation around Nvidia also brings to light several key factors that have impacted samsung’s market position:

- Diversified Product Portfolio: Samsung’s extensive range of electronics and semiconductors helps mitigate risks associated with specific market downturns.

- Strategic partnerships: Collaborations with leading firms in AI and cloud computing bolster Samsung’s relevance and dependency, increasing its growth potential.

- Global Supply Chain Efficiencies: Samsung’s ability to adapt and optimize its production processes ensures resilience even in challenging climates.

Investors are encouraged by these factors as they buy into Samsung’s vision for growth, wich appears promising despite the profits miss.

Profit Miss Dismissed: Understanding Investor Sentiment Surrounding Samsung

Despite a recent profit miss, investor sentiment surrounding Samsung has taken a positive turn, thanks largely to discussions about Nvidia’s potential partnership with the tech giant.Many analysts believe that the prospect of collaboration in the semiconductor space could significantly bolster Samsung’s market position, especially as demand for high-performance computing continues to surge. The excitement surrounding this potential alliance has overshadowed concerns about Samsung’s short-term earnings, leading to a noticeable uptick in share prices.

Key factors contributing to the optimistic atmosphere include:

- Strategic Repositioning: investors are betting on Samsung’s ability to leverage Nvidia’s technology to enhance its own product offerings.

- Market Resilience: Despite ongoing macroeconomic challenges, the tech sector shows signs of recovery, which bolsters confidence in Samsung’s long-term prospects.

- Increased Production capacity: Anticipation of Samsung ramping up its semiconductor production in response to heightened global demand further fuels investor enthusiasm.

This complex interplay of short-term challenges and long-term opportunities is shaping the narrative around Samsung, leading many to remain cautiously optimistic even in the face of an earnings report that fell short of expectations.

Future Prospects: How Strategic Partnerships could Bolster Samsungs Growth

As Samsung navigates the complexities of the tech market, exploring strategic partnerships may prove essential for future growth. Collaborations with industry leaders like Nvidia not only bolster innovation but can also facilitate access to cutting-edge technologies. By forging alliances in domains such as artificial intelligence, cloud computing, and advanced semiconductor technologies, Samsung can further enhance its competitive edge. This forward-thinking approach can position the company to capitalize on emerging trends, ensuring it remains at the forefront of the rapidly evolving landscape.

Furthermore, these partnerships can create synergies that drive efficiencies and reduce costs, ultimately leading to improved profit margins. By integrating their strengths, Samsung and its partners can unlock new revenue streams and expand their market reach.Potential benefits include:

- Joint Research Initiatives: Accelerating the advancement of next-generation products.

- shared Resources: Reducing operational costs thru collaborative ventures.

- Cross-Promotion Opportunities: Enhancing brand visibility and customer loyalty.

Embracing such relationships could prove pivotal for Samsung, allowing the tech giant to adapt swiftly to market demands while continuing to innovate and thrive in a competitive habitat.

Recommendations for Investors: Navigating Samsung Shares in a Volatile market

As traders respond to Samsung’s shares climbing amid Nvidia’s upbeat forecast, investors should consider a multi-faceted approach while navigating the company’s stock in this volatile market. With the backdrop of rising investor sentiment fueled by tech optimism, particularly in the semiconductor sector, it’s crucial to remain vigilant. Analysts suggest that staying informed on key developments and conducting thorough research can definitely help mitigate risks.Hear are several strategies investors should keep in mind:

- Diversification: Spreading investments across various sectors can cushion against potential downturns in any single stock.

- Market Sentiment Monitoring: Keep an eye on global market trends and competitor performance, especially within the semiconductor landscape, which can impact Samsung’s pricing and demand.

- Technical Analysis: Utilize charting tools to identify support and resistance levels, which can aid in making informed trading decisions.

- Long-term viewpoint: While short-term fluctuations may provoke anxiety, a focus on long-term fundamentals can provide better investment outcomes.

Investors should also maintain a close watch on Samsung’s earnings reports and product launches, as these events can lead to significant market shifts. Additionally, being proactive about news related to AI advancements and partnerships, particularly those involving Nvidia, can offer insights into potential growth trajectories. By adopting a balanced approach and utilizing these recommendations, investors can better position themselves in the ever-evolving landscape of Samsung shares.