Sezzle’s Remarkable Recovery: Analyzing the Factors Behind Its Surge

Sezzle’s remarkable rebound can be attributed to several key factors that have reshaped its market dynamic since hitting a low in early 2023. Primarily, the company has successfully diversified its offerings beyond conventional buy-now-pay-later (BNPL) services, introducing new financial products that cater to evolving consumer needs. Among these innovations are:

- enhanced Merchant Partnerships: Collaborations with a wider array of retailers have broadened Sezzle’s reach, attracting a younger, credit-conscious demographic eager for more flexible payment solutions.

- Investment in Technology: Upgrades to its platform have improved user experience considerably, making transactions smoother and boosting customer retention.

- Regulatory Adaptation: The company has effectively navigated the fragmented regulatory landscape surrounding BNPL services, allaying investor fears and enhancing credibility.

Moreover, external market conditions have played a pivotal role in Sezzle’s resurgence. As consumers increasingly turn to alternative financing options amid rising interest rates and economic uncertainty, Sezzle has positioned itself as a viable solution, offering an easier way to shop without the burden of immediate repayment. This shift has been exemplified by:

- Targeted Marketing Campaigns: Strategic marketing efforts have reinforced brand visibility, successfully connecting with consumers wary of traditional credit options.

- Consumer Trust Initiatives: By implementing robust customer protection measures and transparent policies, the company has heightened trust among users, which is crucial in the consumer finance space.

Exploring Market sentiment: How Consumer Demand Fuels Sezzle’s Rise

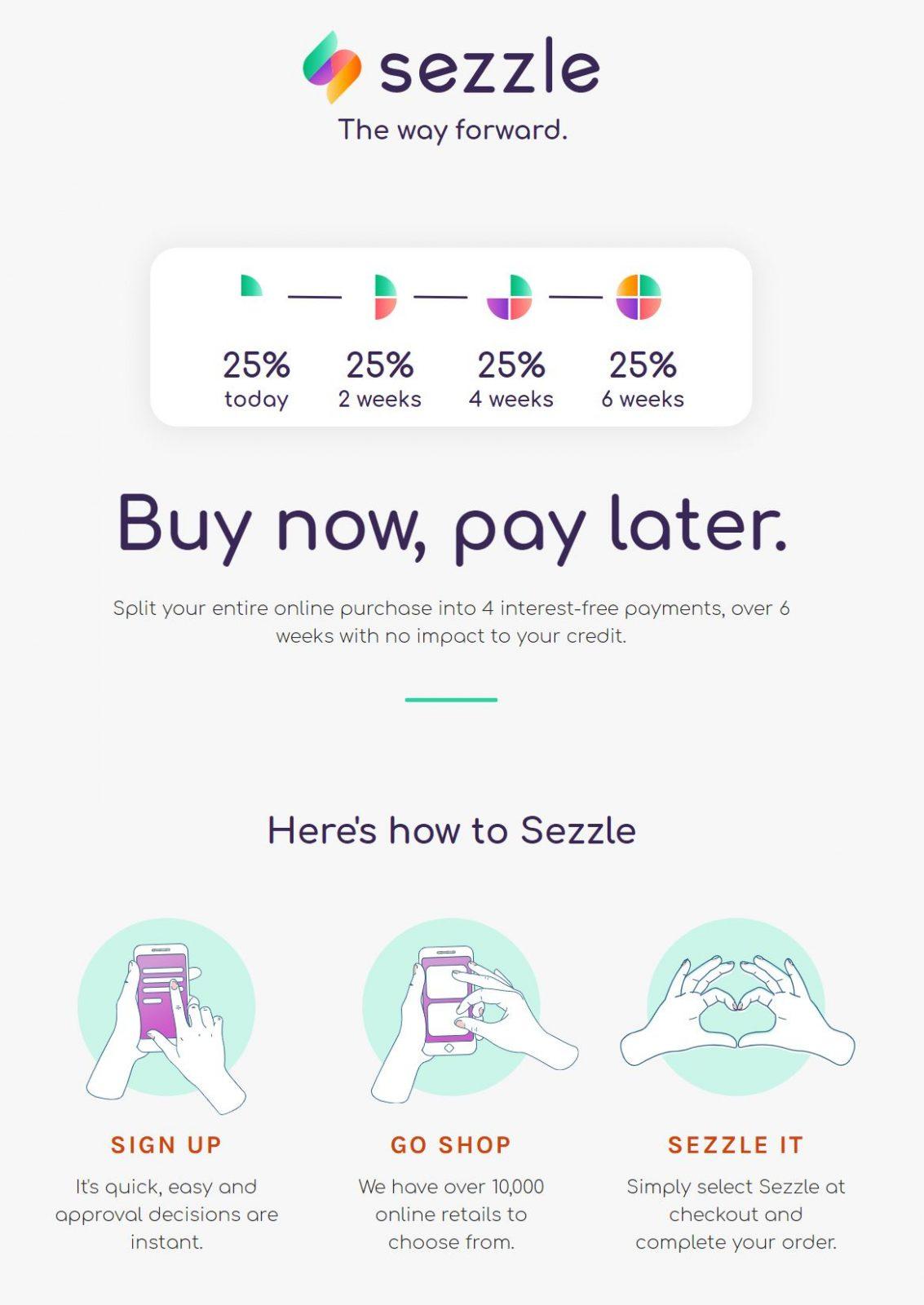

The remarkable surge in Sezzle’s market performance can largely be attributed to a importent shift in consumer sentiment towards alternative payment solutions,especially in the wake of economic uncertainties. As consumers increasingly seek flexible spending options, Sezzle has positioned itself as a frontrunner in the Buy Now, Pay Later (BNPL) market. The company’s ability to tap into the evolving needs of millennials and Gen Z-who prioritize convenience, clarity, and affordability-has propelled its popularity. Sezzle’s unique selling propositions, such as no hidden fees and interest-free installment payments, resonate deeply with a demographic that values financial adaptability.

Furthermore, the growing emphasis on e-commerce has further fueled Sezzle’s growth trajectory. As retail landscapes continue to evolve,online shopping habits have solidified,and consumers are gravitating toward platforms that offer seamless checkout experiences.The integration of Sezzle’s payment solutions with major retail partners has expanded its reach, creating a symbiotic relationship that benefits both merchants and consumers. Key indicators demonstrating this enhanced consumer demand include:

- Increased merchant adoption: high-profile partnerships have bolstered brand visibility.

- Rising transaction volumes: A marked increase in the number of active users opting for Sezzle payments.

- Market surveys: Consumer preferences show a growing favor for BNPL options over traditional credit products.

Investment Insights: What This Surge Means for Stakeholders and Future Prospects

The dramatic uptick in Sezzle’s stock price, surging an astounding 7,000% since its 2023 lows, has sent ripples throughout the financial community, capturing the attention of investors and analysts alike. This unprecedented surge can be attributed to several key factors that have reshaped market perceptions and investor confidence. Among them are:

- Innovative Partnerships: Sezzle’s strategic alliances with major retailers have bolstered its credibility and visibility in the Buy Now, Pay Later (BNPL) market, allowing it to tap into a broader customer base.

- Regulatory Shifts: The evolving regulatory landscape has provided a more favorable environment for BNPL services, giving platforms like Sezzle a unique advantage to thrive amidst increasing competition.

- Technological Advancements: Enhanced user experience through improved app functionality and faster approvals has made Sezzle a preferred choice for consumers, driving up transaction volumes.

Stakeholders observing this meteoric rise are forced to reconsider their forecasts, especially with the company demonstrating resilience in a challenging economic climate. For the financial institutions and investors backing Sezzle, this remarkable rebound may signal a pivotal moment for modern payment solutions, and it encourages deeper investigation into the sustainability of this growth. Moreover, considerations around future prospects highlight a potential shift in consumer spending habits, where flexible payment options are becoming increasingly essential. As Sezzle’s story continues to unfold, stakeholders must remain agile and adaptive, prepared to seize further opportunities in this evolving market landscape.

Navigating the BNPL landscape: Recommendations for Consumers and Investors

As the Buy now, Pay Later (BNPL) sector experiences unprecedented growth, both consumers and investors must adopt a strategic mindset to navigate this evolving landscape. For consumers, understanding the terms and conditions associated with BNPL products is essential to avoid unforeseen pitfalls. Key considerations include:

- Interest rates: Some BNPL options may come with hidden fees or higher interest rates post-promotional periods.

- Repayment Terms: Awareness of the repayment schedule can prevent overextension and missed payments.

- Consumer Protections: Familiarize yourself with consumer rights and protections related to BNPL transactions.

Investors, on the other hand, should closely monitor market trends and assess the competitive landscape to make informed decisions. With companies like Sezzle showing remarkable recoveries, a few factors come into play for potential investors:

- Market Position: Analyzing the company’s market share and its position relative to competitors can indicate future growth prospects.

- Regulatory Environment: Staying updated on potential regulations surrounding BNPL services will provide insight into sustainability and growth.

- Customer Base Growth: Evaluating how well a company is expanding its user base can serve as an indicator of its overall viability in the sector.