Swiss Chipmaker U-blox Engages in Potential Takeover Talks with Advent International

In a meaningful progress for the semiconductor industry, U-blox, the Swiss chipmaker renowned for its advanced positioning and wireless dialogue technologies, has confirmed that it is engaged in discussions with Advent International regarding a potential takeover. This revelation has sent ripples through the market, igniting speculation about the implications of the deal for both companies.U-blox has stated that these talks are in the preliminary stages,and there is no guarantee of a transaction occurring,yet the prospect raises questions about the future direction and strategic growth of U-blox.

Market analysts are contemplating the potential benefits and challenges that such a merger could present. Some of the key factors under consideration include:

- Expansion Opportunities: Advent International’s substantial investment capabilities could provide U-blox with the necessary capital for research and development.

- Market Position: A successful takeover could enhance U-blox’s competitiveness in the rapidly evolving tech landscape.

- Innovation Boost: Collaborating with Advent may accelerate U-blox’s innovation pipeline, particularly in AI and IoT applications.

As the talks progress, stakeholders are urged to keep a watchful eye on developments that could reshape the landscape of the semiconductor sector, particularly as demand for advanced technologies continues to soar.

Implications of U-blox’s Strategic Move for the Semiconductor Industry

The potential acquisition of U-blox by Advent represents a pivotal moment in the semiconductor landscape, which has been characterized by rapid advancements and fierce competition. With U-blox’s stronghold in precision positioning and communication technologies, a merger could allow Advent to tap into new revenue streams, fostering innovation and expanding its market presence. As larger players continue to consolidate, this strategic move could herald a new era where specialized companies like U-blox are viewed as attractive assets for investment firms keen on diversifying their portfolios.

Moreover, this development could intensify the competition among semiconductor firms, pushing them to reevaluate their strategies and capabilities.The implications may extend beyond U-blox and Advent, influencing:

- Investment Trends: Increased interest in niche players may lead to more aggressive acquisitions within the sector.

- Technological Convergence: Companies may seek collaborative synergies, driving innovation across various applications.

- Market Dynamics: Smaller firms could be pressured to merge or partner to enhance their competitive edge against larger incumbents.

As the semiconductor industry braces for these shifts, stakeholders must remain vigilant and adaptable to seize potential opportunities arising from this evolving landscape.

Expert Insights on the Future of U-blox and Potential Synergies with Advent

As discussions between U-blox and Advent gain momentum, industry experts suggest that the potential for collaboration could lead to groundbreaking advancements in the semiconductor sector. U-blox, known for its innovative positioning and wireless communication technologies, is highly likely to leverage Advent’s robust financial backing and strategic management expertise. Key insights highlight several areas where synergies may emerge:

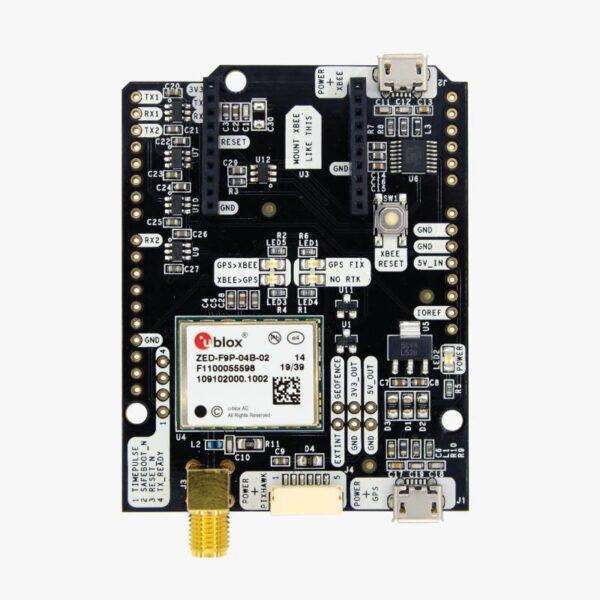

- Enhanced R&D Capabilities: With Advent’s investment, U-blox could significantly ramp up its research and development efforts, enabling faster innovation cycles in GPS and IoT solutions.

- Market Expansion: Advent’s extensive network could facilitate U-blox’s entry into new markets, particularly in North America and Asia, where demand for connected devices is surging.

- Optimized Supply Chain: Combining operational strengths may lead to more efficient supply chain logistics, reducing costs and improving product delivery timelines.

Moreover, analysts predict that this strategic alliance could set a new benchmark in the industry, particularly in how companies navigate the complexities of regulatory environments and technological advancements.the integration of Advent’s financial acumen with U-blox’s pioneering spirit could culminate in a formidable entity capable of addressing the evolving challenges of connectivity and data management in an increasingly digital world.

Recommendations for Investors Amidst the Evolving Landscape of Chipmaking

As the chipmaking industry undergoes significant transformations, investors must remain vigilant and adaptable. The possibility of mergers and acquisitions, such as U-blox’s discussions with Advent, highlights the increasing consolidation in the market. To navigate this shifting landscape, investors should consider the following strategies:

- Diversification: Spread investments across various segments within the semiconductor sector to mitigate risks associated with any single company’s performance.

- due Diligence: Conduct thorough research on companies involved in strategic talks, assessing their financial health, technological advancements, and market positions.

- Long-term Outlook: Adopt a mindset focused on long-term growth. The chip industry may face fluctuations, but innovation and demand for technology-driven solutions present sustainable opportunities.

Furthermore, investors should stay informed about emerging trends such as artificial intelligence, automotive chip demand, and the expansion into Internet of Things (IoT) applications. Monitoring policies and regulations that may affect supply chains and production capacities can provide essential insights into potential future challenges and rewards.Key recommendations include:

- Engagement with Analysts: Regularly consult with market analysts to gain insights into forecasted trends and investment sentiments.

- Networking: Build relationships within the industry to capitalize on shared knowlege and insider perspectives that may inform more strategic investment choices.

- Scenario Analysis: Prepare for various market scenarios by evaluating potential impacts of geopolitical tensions and technological shifts on the semiconductor landscape.