Taiwan’s Insurance Sector Sees a Turnaround in Profitability Post Reserve regulation Changes

Taiwan’s insurance companies are experiencing a meaningful boost in profitability following teh implementation of new reserve regulation changes. these adjustments, aimed at enhancing the financial stability of the sector, have led to a remarkable recovery in profit margins. Insurers are now better positioned to manage their liabilities and improve their overall financial performance.Key factors contributing to this resurgence include:

- Increased openness: The new regulations promote clearer accounting practices, allowing insurers to better assess their risk exposures.

- Strengthened capital buffers: Enhanced reserve requirements ensure that companies maintain sufficient funds to meet policyholder claims.

- Improved risk management: The updated framework encourages a more proactive approach to underwriting, enabling firms to identify and mitigate risks effectively.

As insurers digest the implications of these regulatory adjustments, many are reporting a surge in their investment portfolios, resulting in higher returns and improved solvency ratios. The sector’s optimism is reflected in the confidence among stakeholders, as companies are now exploring new avenues for growth and innovation. With an eye toward sustainability and digital conversion, insurers are increasingly investing in technology and customer engagement strategies. This pivot not only promises enhanced operational efficiency but also positions the industry for long-term success:

- Investment in technology: Digital platforms are being leveraged to streamline processes and improve customer interactions.

- Diverse product offerings: Insurers are expanding their product lines to cater to evolving consumer needs.

- Focus on sustainability: Environmental, social, and governance (ESG) criteria are becoming integrated into corporate strategies.

Understanding the Impact of New Reserve Rules on Financial Stability and Risk Management

The recent implementation of new reserve rules has transformed the landscape for insurers in Taiwan, leading to a striking rebound in profitability. By adjusting the guidelines on how reserves must be held, regulators have streamlined balance sheets, enabling companies to free up capital that was previously tied down. This newfound capital has allowed insurers to engage in more aggressive asset management strategies while ensuring they can meet policyholder claims without undue delay. The following changes have played a crucial role in enhancing financial stability:

- improved liquidity position: Companies can now allocate assets more efficiently,ensuring they have quick access to funds.

- Enhanced risk assessment: Insurers are better equipped to understand and manage their risk profiles considering current market conditions.

- More competitive market environment: With a healthier financial position, many firms are actively pursuing innovative products and services.

This shift in reserve management not only helps insurers maintain solvency but also bolsters public confidence in the sector. By reducing the likelihood of sudden market shocks due to under-reserving, these new rules create a more predictable environment for both policyholders and investors. insurers are now in a better position to contribute positively to economic growth while managing risks more effectively, aligning with global best practices. Key benefits of these changes include:

- Stronger regulatory framework: Enhanced oversight ensures companies comply with updated standards.

- Increased investment in technology: Firms are now directing resources towards developing elegant risk management systems.

- Greater transparency: Policyholders can have more confidence in their insurers’ financial health.

Expert Insights on Strategic Adjustments by Insurers to Maximize Returns

The recent overhaul of reserve rules in Taiwan has prompted insurers to adopt innovative strategies that not only stabilize their financial footing but also enhance profitability.As regulatory frameworks evolve, companies are increasingly focused on optimizing their investment portfolios and risk management techniques.Key strategies emerging from this shift include:

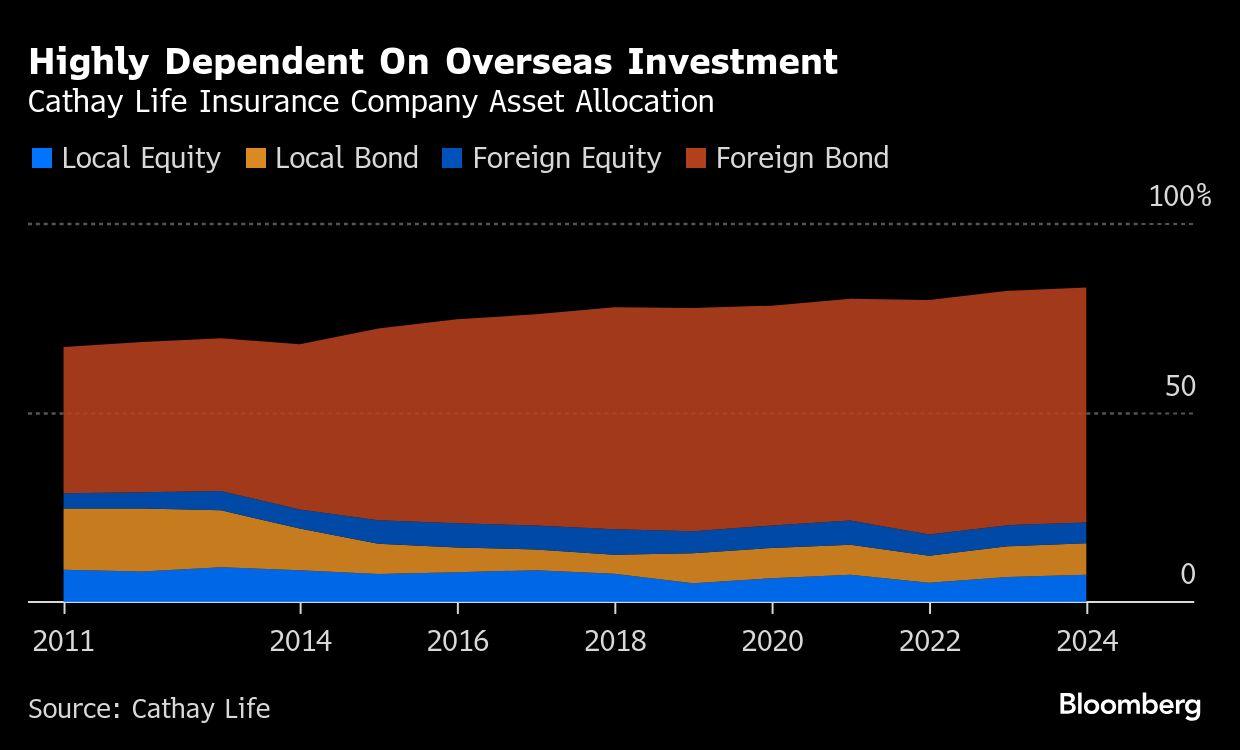

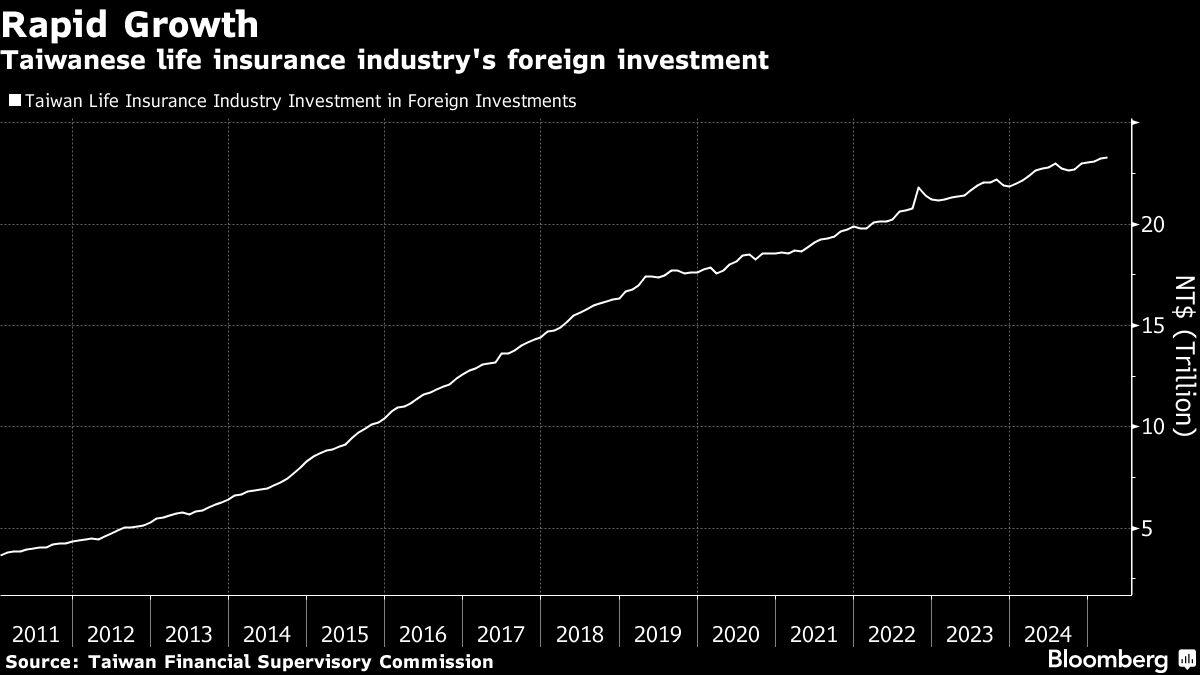

- Diversification of Investment Assets: Insurers are venturing beyond traditional asset classes, exploring alternatives such as real estate, private equity, and infrastructure projects, allowing for greater returns while mitigating risks.

- enhanced Data Analytics: Leveraging advanced analytics tools, companies can refine underwriting processes and pricing models, leading to more accurate risk assessments and better profit margins.

- Focus on Customer-Centric Products: By tailoring insurance offerings based on emerging consumer demands, insurers can retain clients and open new revenue streams, ensuring enduring growth in a competitive market.

Moreover, the shift towards a more dynamic capital allocation strategy is reshaping the operational landscape for these insurers. With an emphasis on real-time performance tracking,many firms are revisiting their capital reserves to ensure agility in market response. Industry experts note that this proactive approach not only aligns with regulatory requirements but also fosters a culture of financial resilience among insurers. Significant advantages are seen in:

- Streamlined Processes: Companies are automating routine tasks, freeing up resources for strategic initiatives that drive long-term value.

- Collaboration with Fintech: Partnerships with technology firms are enhancing product delivery and improving customer engagement, ultimately leading to increased market share.

- Emphasis on Sustainability: Insurers are incorporating ESG (Environmental, Social, and Governance) principles into their investment strategies, aligning their operations with global sustainability trends while appealing to socially conscious consumers.

Recommendations for Policyholders: Navigating the Enhanced Insurance Landscape in Taiwan

as the insurance landscape in Taiwan evolves following the recent implementation of enhanced reserve regulations, policyholders must adapt their strategies to navigate this shifting environment effectively. To ensure that you remain well-informed and adequately protected, consider the following recommendations:

- Review Your Coverage: Take the time to thoroughly examine your current insurance policies. Assess whether they still meet your needs considering the regulatory changes, focusing on areas such as premium adjustments and claims handling processes.

- Engage with Your Insurer: Don’t hesitate to reach out to your insurance provider for clarity on how these new reserve rules impact your existing policies. Open communication can help you understand potential shifts in pricing and policy conditions.

- Stay informed About Market Trends: Keep abreast of changes within the broader insurance market in Taiwan. New products may emerge in response to regulatory changes, presenting you with opportunities to enhance your coverage.

- Consider Professional guidance: Consult with a financial advisor or insurance broker who can offer tailored advice based on your personal circumstances and the latest regulatory framework.

In the wake of insurers rebounding to profitability, it’s vital to recognize that this can influence how companies approach risk and pricing strategies. As a savvy policyholder, you may want to monitor your insurer’s financial stability and claims history to gauge their reliability. Additionally, explore the growing trend of digital tools within the insurance sector that facilitate easier access to policy information and streamline claims processes. Embracing these advances not only enhances your experience but may also empower you to make informed decisions that align with your financial goals.