Understanding the Impact of Tariffs on Global Markets

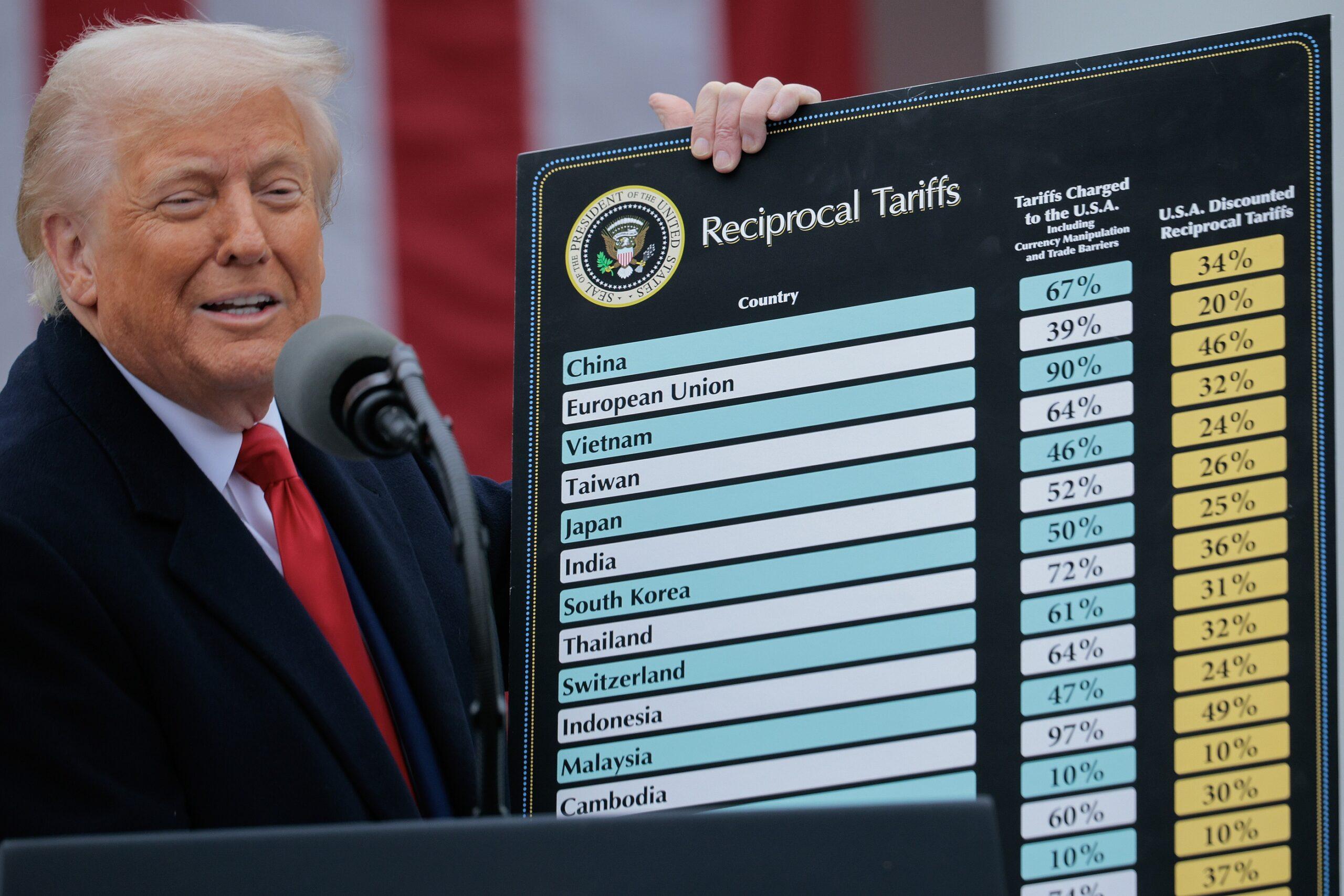

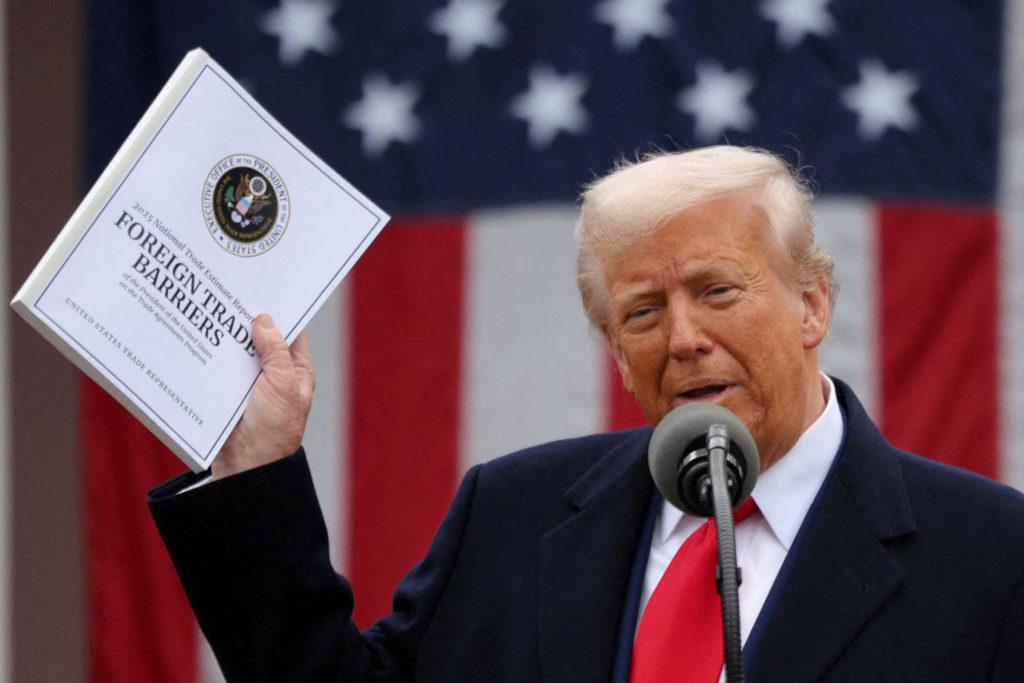

The recent surge in tariffs has reverberated across global markets, igniting uncertainty and fluctuation in stock prices, trade balances, and investor sentiment. As countries impose tariffs on each other’s goods, businesses face increased costs, leading to potential price hikes for consumers. Some important factors to consider include:

- Supply Chain Disruption: Increased tariffs can disrupt established supply chains, forcing companies to reconsider sourcing strategies and possibly resulting in higher operational costs.

- Market Volatility: trade policies can drastically shift market dynamics, with sectors like manufacturing and agriculture particularly vulnerable to sudden tariff announcements.

- Foreign Investment: Uncertainty regarding trade policies can deter foreign investments, as investors seek more stable environments, thereby impacting long-term economic growth.

Moreover, the retaliatory measures frequently enough taken by affected nations can escalate tensions, leading to broader geopolitical implications. Industries reliant on exports may find themselves wrestling with reduced demand in key markets, while import-dependent businesses struggle to absorb added costs. Key aspects to watch in the coming months include:

- Economic Indicators: Accurately gauging the health of economies affected by tariffs can provide insight into potential recessions or recoveries.

- Negotiation Outcomes: Diplomatic efforts to resolve trade issues could mitigate some impacts,but may also create uncertainties if progress stalls.

- Public Sentiment: Consumer reactions to rising prices tied to tariffs can influence political landscapes and drive changes in policy.

Economic Indicators to Watch Amid Tariff Uncertainty

The current landscape of economic indicators is crucial for assessing the impact of tariff uncertainty on markets. Analysts recommend paying close attention to the following key metrics:

- Consumer Confidence Index (CCI): This measure reflects consumer sentiment, which can be directly affected by uncertainty around tariffs, influencing spending behaviors.

- Manufacturing PMI: The purchasing Managers’ Index for manufacturing provides insights into industry health and can signal shifts caused by changes in tariffs.

- Import and Export Data: Monitoring trade balance information helps paint a clearer picture of how tariffs are reshaping trade dynamics and international relationships.

- Inflation Rates: Tariffs can lead to price increases, so keeping an eye on consumer and producer price indices is essential to understand inflationary pressures.

Moreover, employment statistics, particularly in manufacturing sectors heavily impacted by trade policy, can reveal the broader effects of tariffs on the labor market. Other vital indicators include:

- Gross Domestic Product (GDP) Growth: Analyzing GDP growth rates allows economists to infer the overall economic health amid trade headwinds.

- Stock Market Volatility: Sharp fluctuations in the stock market frequently enough respond to tariff announcements, making it a valuable indicator of market sentiment.

- Business Investment Spending: This illustrates whether companies are expanding operations or holding back due to uncertainty, providing insight into future economic activity.

Strategies for Investors in a Volatile Trade Environment

In an environment marked by uncertainty and rapid price fluctuations, investors need to adopt a multilayered approach to safeguard their assets.Diversification remains a cornerstone strategy, allowing investors to spread risk across various sectors and asset classes. This can be achieved through:

- Equities: Invest in multiple industries to counterbalance sector-specific downturns.

- Fixed Income: Allocate funds to bonds or other fixed-income securities to smooth out returns.

- Option Investments: Consider commodities, real estate, or cryptocurrencies to hedge against traditional market volatility.

Another critical strategy is to stay informed and agile. Monitoring geopolitical developments, economic indicators, and trade policies can provide crucial insights that impact market movements. Investors should also consider implementing stop-loss orders to limit potential losses,alongside being ready to adjust their portfolios based on changing market conditions. Engaging with financial advisors for tailored advice can further enhance decision-making, helping investors navigate through the turbulent waters of a volatile trade environment.

Long-term Outlook: Adapting to a New Economic Landscape

The recent fluctuations in the market, spurred by changes in tariff policies, have forced businesses and investors alike to reconsider their strategies in an increasingly complex economic environment. As nations navigate through trade agreements and retaliatory measures, the long-term impact on global supply chains and pricing will be notable. Companies that once relied on stable tariff structures now find themselves in a landscape marked by uncertainty, making it crucial to adapt promptly. Key factors to monitor include:

- Supply chain Resilience: The ability to pivot suppliers and logistics to mitigate tariff impacts.

- Market Demand forecasting: Anticipating shifts in consumer behaviour in response to rising prices.

- Regulatory Compliance: Staying updated on new trade regulations and their implications.

As businesses come to terms with evolving economic dynamics, innovation and versatility will be paramount. Organizations that embrace technological advancements and diversification in product offerings will likely find themselves better positioned to weather these changes. Moreover, fostering strong relationships with international partners can provide a buffer against external shocks.companies should focus on the following strategies to enhance their long-term viability:

- Investing in Local Production: Reducing reliance on imports to circumvent tariff costs.

- Enhancing Digital Capabilities: Streamlining operations through technology to improve efficiency.

- Engaging in Lobbying Efforts: Advocating for favorable trade policies that could alleviate financial burdens.