Tesla Stock Positioned for Growth Amid Valuation Uncertainties

The latest analysis from Melius Research has ignited discussions surrounding Tesla’s stock, which remains a focal point for investors grappling with its shifting valuation landscape. Despite lingering uncertainties, Melius argues that the electric vehicle manufacturer is well-positioned for future growth. Several factors bolster this assertion:

- Innovation Leadership: Tesla continues to lead the charge in electric vehicle technology, consistently unveiling advanced features that set it apart from competitors.

- Market Expansion: The company is strategically expanding its footprint globally, tapping into emerging markets that present lucrative opportunities for EV adoption.

- Sustainability Focus: As the world pivots towards renewable energy solutions, Tesla’s commitment to sustainability resonates with a growing base of environmentally conscious consumers.

Yet, investors remain cautious due to fluctuating valuation models that can often seem speculative.Analysts highlight a broad range of metrics-profitability, potential market share, and revenue growth-that make establishing a conclusive valuation challenging. Melius suggests that while the stock’s valuation may feel uncertain, the underlying fundamentals point towards a positive trajectory. They emphasize that Tesla’s capacity to innovate and adapt is likely to keep it relevant in the fast-changing automotive landscape, thus reinforcing its appeal as a long-term investment.

Investing in Innovation: Why Melius Advocates for Tesla as a Core Holding

In the ever-evolving landscape of technology and clean energy, Melius Research has positioned Tesla as a pivotal player, urging investors to consider its stock a fundamental component of their portfolios. The firm’s analysts argue that Tesla transcends traditional automotive boundaries, leading the charge in not only electric vehicles but also in energy solutions and autonomous technology. This expansive vision aligns with the global shift towards sustainability, making Tesla a core holding for those looking to capitalize on the future of transportation and energy.

Despite the inherent challenges of accurately assessing the company’s valuation-where figures can seem more like educated guesses than concrete data-Melius highlights several key factors that support Tesla’s long-term potential. Among these are:

- Robust innovation pipeline: Tesla’s continuous advancements, from battery technology to full self-driving capabilities, signify a commitment to staying ahead.

- Brand loyalty and market dominance: With a growing customer base and established brand equity, Tesla remains a frontrunner in the EV market.

- Scalability: The company’s ability to scale operations efficiently positions it favorably against competitors.

These elements collectively contribute to Melius’s bullish stance, emphasizing that, while factors of uncertainty loom regarding valuation metrics, the strategic foresight and operational execution of Tesla make it an indispensable asset for forward-thinking investors.

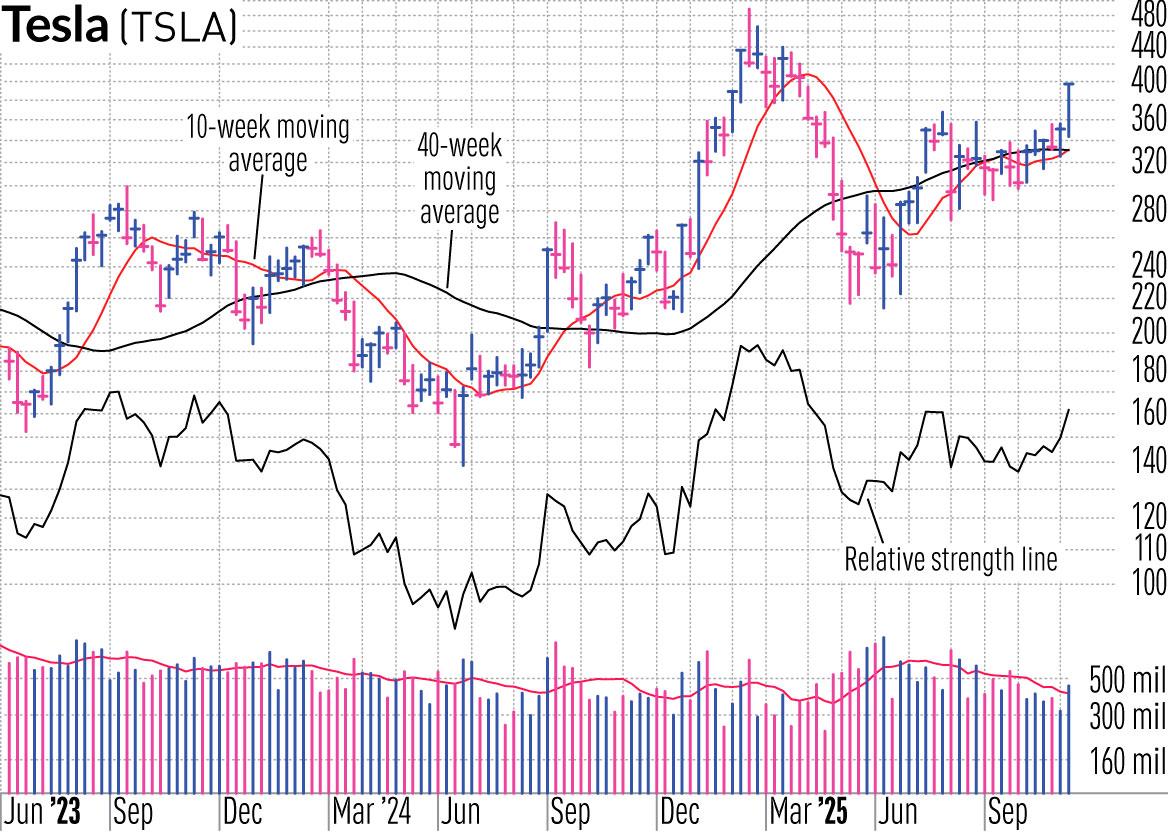

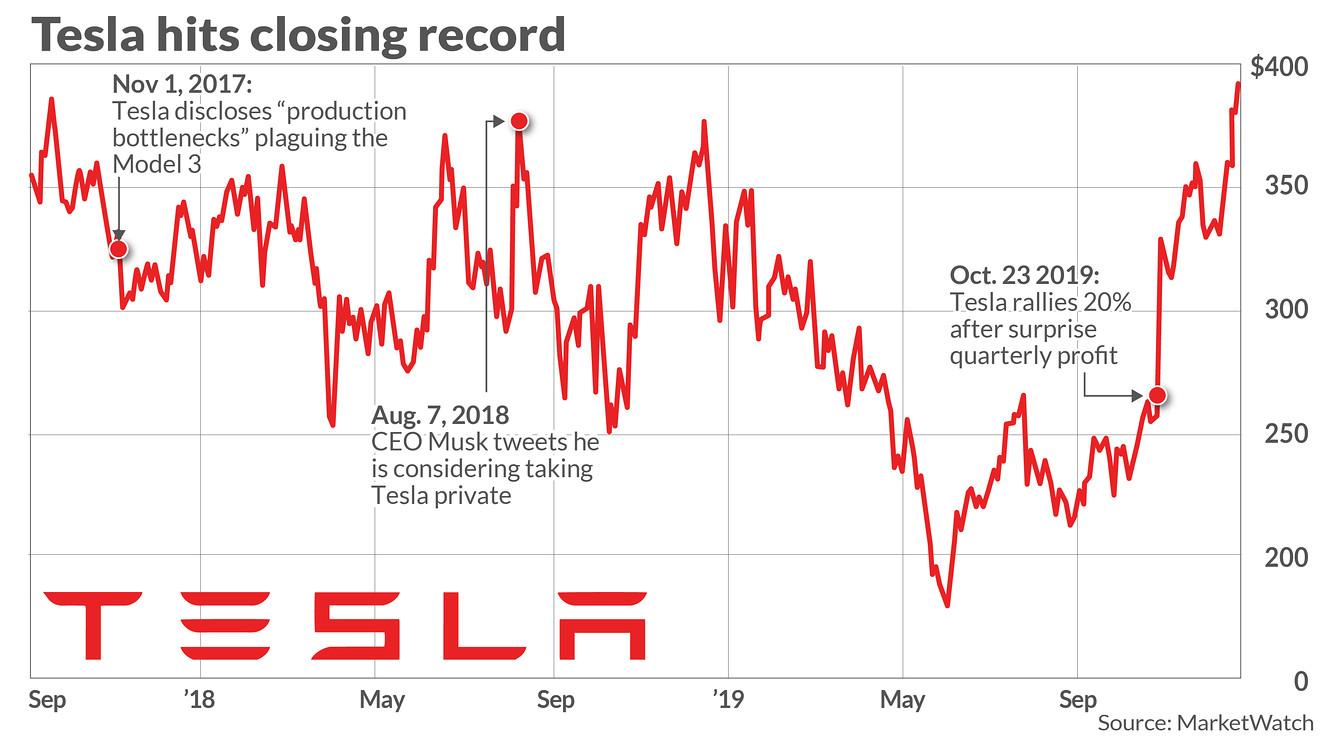

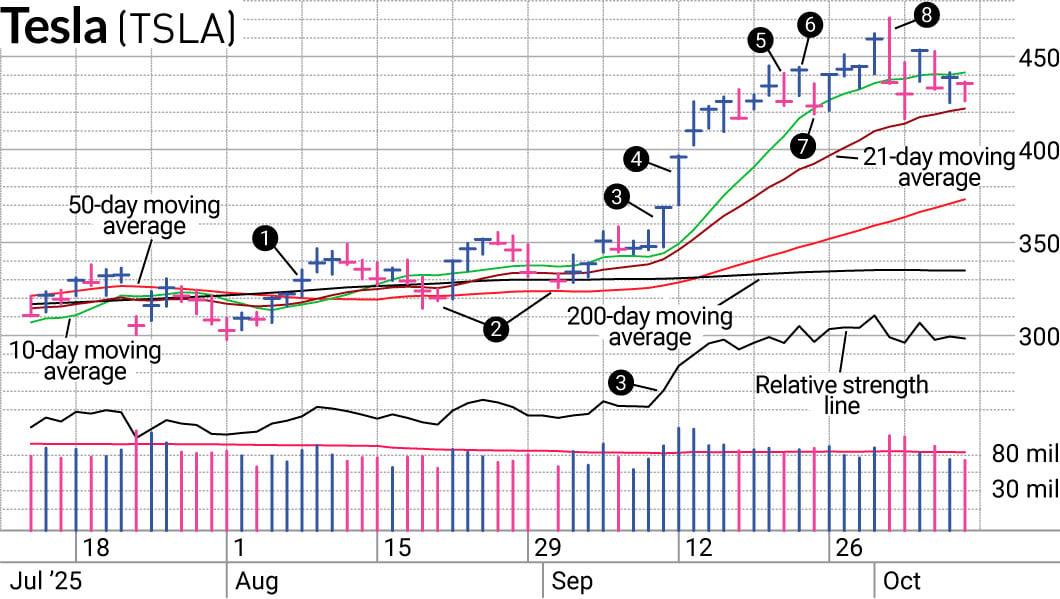

Navigating the Volatility: Key Factors Influencing Tesla’s Stock Performance

the recent fluctuations in Tesla’s stock can be largely attributed to a confluence of macroeconomic factors, investor sentiments, and company-specific developments. Interest rates play a important role; with the Federal Reserve’s policy decisions impacting borrowing costs, higher rates could dampen consumer demand for electric vehicles. Furthermore, supply chain challenges persist, as raw material shortages and logistical delays continue to threaten production capabilities.In addition, the broader automotive market dynamics, notably competition from both legacy automakers and emerging EV manufacturers, are compelling Tesla to innovate constantly while managing its pricing strategies. These elements create a complex landscape for investors trying to grasp the true value of Tesla’s stock.

As tesla continues to expand its manufacturing footprint globally, geopolitical tensions and trade relations also come into play. The company’s reliance on global supply chains means that disruptions in key regions could adversely impact delivery timelines and operational costs. On the technology front, advancements in battery technology and software updates are critical as they not only improve vehicle performance but also enhance the overall customer experience. Moreover, Tesla’s strength in building a robust charging infrastructure will be crucial for sustaining its lead in the EV market. As such, while the stock remains an appealing option for many investors, accurately gauging its valuation amidst these variables is a formidable, if not impossible, task.

Future Prospects: Understanding Tesla’s Market potential and Investor Sentiment

Amid the fluctuating landscape of the electric vehicle (EV) market, Tesla continues to stand out as a focal point for investors seeking long-term gains. Analysts at Melius Research assert that while precise valuation remains elusive, the underlying market dynamics suggest that Tesla’s growth potential is significant. The company is well-positioned to capture a larger share of the EV market, driven by advancements in battery technology, autonomous driving features, and an expanding global manufacturing footprint. Highlights of Tesla’s market positioning include:

- Innovative technology: Tesla’s relentless push for technological advancements keeps it ahead of competitors and positions the brand as synonymous with cutting-edge EV solutions.

- diverse Product Range: With models varying from the compact Model 3 to the luxury Model S, Tesla appeals to a broad spectrum of consumers.

- Global Expansion: New factories in strategic locations worldwide bolster Tesla’s ability to meet increasing demand efficiently.

The prevailing investor sentiment around Tesla reflects a mixture of optimism and caution. Despite valuation uncertainties, many view Tesla as a crucial component of a diversified investment portfolio. Factors influencing investor confidence include the company’s strong brand loyalty, the ongoing transition toward enduring energy sources, and its ability to outperform conventional automakers in both sales and innovation. Key aspects of investor sentiment are:

- Long-Term Vision: investors recognize Tesla’s commitment to sustainability and its potential to drive future revenue growth.

- Market Leadership: As a leader in the EV space, Tesla’s brand equity and market recognition inspire confidence among shareholders.

- Cultural Impact: Tesla’s influence extends beyond vehicles, shaping perceptions about renewable energy and technology in broader consumer sectors.