US IPO Delays Prompt European Startups to Explore Regional Markets

The slowdown in the US IPO market has left numerous European startups reevaluating their path to public status. with the backlog of companies eager to go public, those eyeing the American market are beginning to shift their focus closer to home. This pivot is not merely a reactionary measure; rather, it reveals a growing confidence in regional markets and their ability to support the next wave of innovation. Venture capitalists and entrepreneurs alike are now considering the benefits of local listings, which offer potential access to dedicated investor bases familiar with their businesses and operational landscapes.

industry experts highlight several key factors contributing to this trend:

- Valuation Stability: Local markets may provide more predictable valuations amid the fluctuations seen in the US.

- Stronger regulatory Frameworks: European exchanges typically involve less complexity in regulatory compliance compared to their US counterparts.

- Enhanced Community Support: Regional investors are more likely to champion homegrown companies, fostering a broader ecosystem of support.

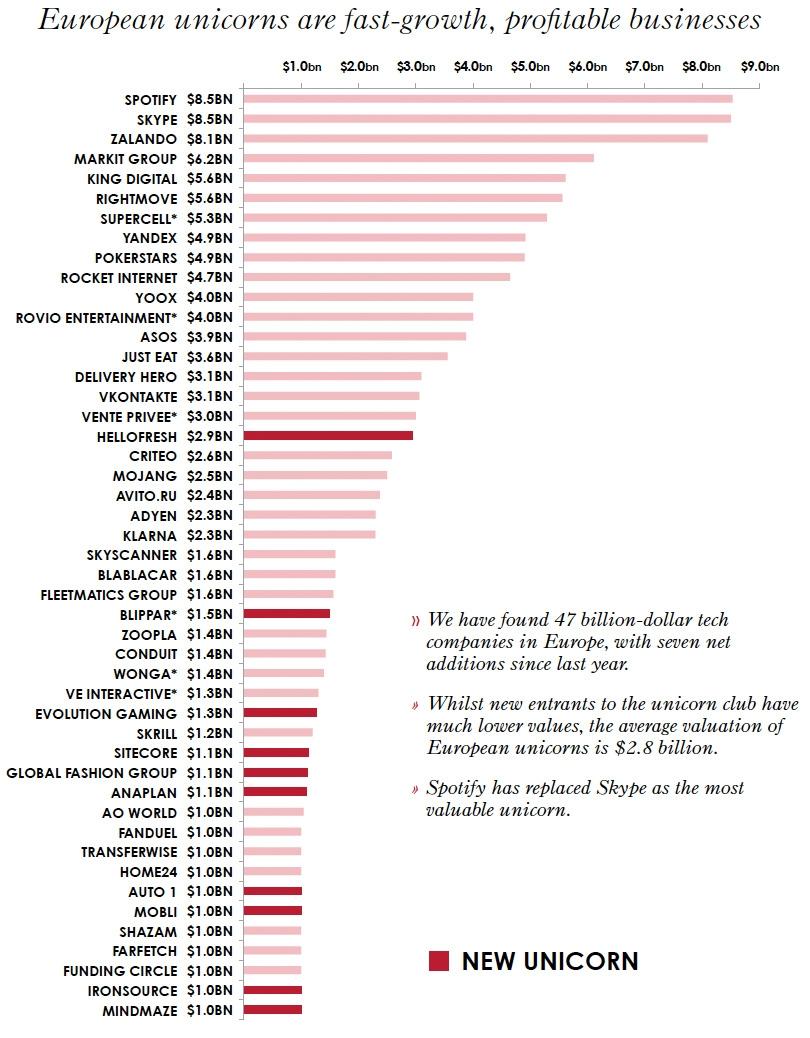

As more unicorns explore these regional alternatives, the European IPO landscape is poised for significant transformation, fostering a more robust habitat for innovative companies to flourish.

Impact of the US Backlog on European Unicorn Valuation Trends

The ongoing backlog in the US IPO market has lead european unicorns to reconsider their trajectories, focusing more intently on domestic listings. These companies, previously enticed by the allure of Wall Street, are finding that the hurdles in the American market—coupled with shifts in investor sentiment—are prompting them to explore local options.Recent analyses reveal that many European startups are positioning themselves for a future where local exchanges might offer a more stable and favorable environment for public offerings. as a result, several key factors are influencing this trend:

- Regulatory Advantage: European markets may provide a more streamlined regulatory framework, reducing the time and costs associated with going public.

- investor confidence: Home-grown investors are becoming more supportive of local listings, seeing potential in the European tech ecosystem.

- Market Valuations: With increased attention on local stocks, some unicorns may actually achieve better valuations in their regional markets than they would overseas.

This shift is further amplified by the growing recognition of Europe as an innovation hub, where tech companies can thrive without the daunting pressures frequently enough associated with US markets. As European unicorns reevaluate their strategies, they are likely to redefine what success looks like in terms of growth and public funding. The focus on local IPOs, therefore, not only reflects immediate economic conditions but also suggests a more profound transformation within the European investment landscape.

Strategic Considerations for European Firms Pursuing Local Listings

As European unicorns increasingly turn their sights toward local Initial Public Offerings (IPOs),several strategic considerations emerge that could shape their success in domestic markets. Market sentiment plays a pivotal role, as firms must gauge investor appetite and readiness to embrace new entrants in regions still grappling with economic uncertainties. Additionally, regulatory landscapes vary widely across European nations, necessitating a thorough understanding of local compliance requirements. Firms aiming for a smooth transition must prioritize adaptability and awareness of how regional factors can impact investor perception and valuation.

Furthermore, timing is essential; with U.S. markets experiencing IPO backlogs, seizing the opportunity to debut locally while investor enthusiasm is high could provide a significant advantage. Companies should also consider the potential benefits of gaining visibility within their home markets, which can enhance brand strength and foster relationships with local stakeholders. Establishing robust investor relations strategies, including clear interaction of growth plans and financial health, is key to cultivating trust and ensuring a prosperous public entry in an environment where competition for investor attention remains fierce.

Citi’s Recommendations for Successfully Navigating European IPO Landscape

As European unicorns contemplate their entries into the public markets amidst a backlog of US IPOs, Citi has outlined key strategies to navigate this landscape effectively. Understanding local regulations and market conditions is paramount; companies should undertake thorough research to comprehend the intricacies of the European regulatory framework.Additionally, engaging with seasoned advisors can facilitate smoother transitions and bolster strategy formulation tailored to regional expectations.

Companies looking to capitalize on the European IPO environment should prioritize building robust investor relationships well in advance of their public debut.This involves not only establishing a strong marketing narrative but also ensuring transparent and consistent communication with potential investors. Furthermore, firms should consider timing their entry strategically, taking into account macroeconomic conditions and potential market volatility, to optimize their chances for a successful listing and long-term growth post-IPO.