Venture Capital Exodus: Understanding the Factors Behind the Shift

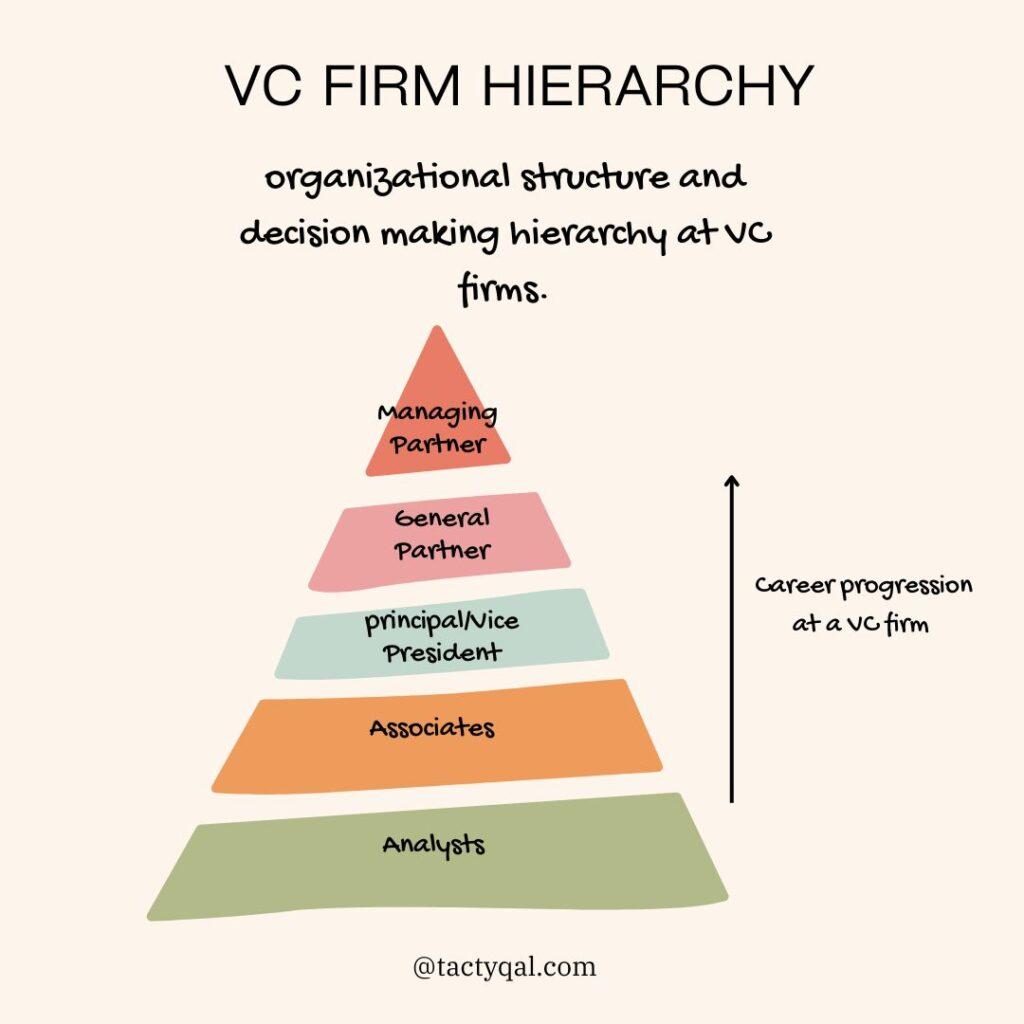

The recent wave of departures from established venture capital firms has sparked widespread discussion among industry observers and stakeholders. High-profile partners are opting to leave their positions, seeking more autonomy and the opportunity to manage smaller, more agile funds. This migration has been prompted by a confluence of factors, including:

- Increased Competition: The landscape has become crowded with new players and option financing options enticing investment talent away from traditional firms.

- Desire for Flexibility: Many partners express frustration over rigid structures and are driven to create their own investment strategies that resonate with their personal philosophies.

- Changing Market Dynamics: As tech sectors evolve, venture capitalists are drawn to opportunities in emerging markets, leading them to seek new platforms where they can pursue innovative ideas.

This exodus is more than just a trend; it reflects a essential shift in the venture capital ecosystem.As investors prioritize cultural alignment and operational independence, the implications for the larger firms could be important. Established firms that previously held sway over the market must now reconsider their approaches to retain talent and foster an habitat conducive to innovative thinking. options like:

- Enhanced Incentives: Revisiting compensation structures to attract and retain top talent.

- Cultivating Diversity: Building inclusive cultures that resonate with a broader range of investors and entrepreneurs.

- Embracing New Technologies: Adapting to recent advancements that streamline due diligence and portfolio management.

Impact on Startups: What This Means for Emerging Businesses

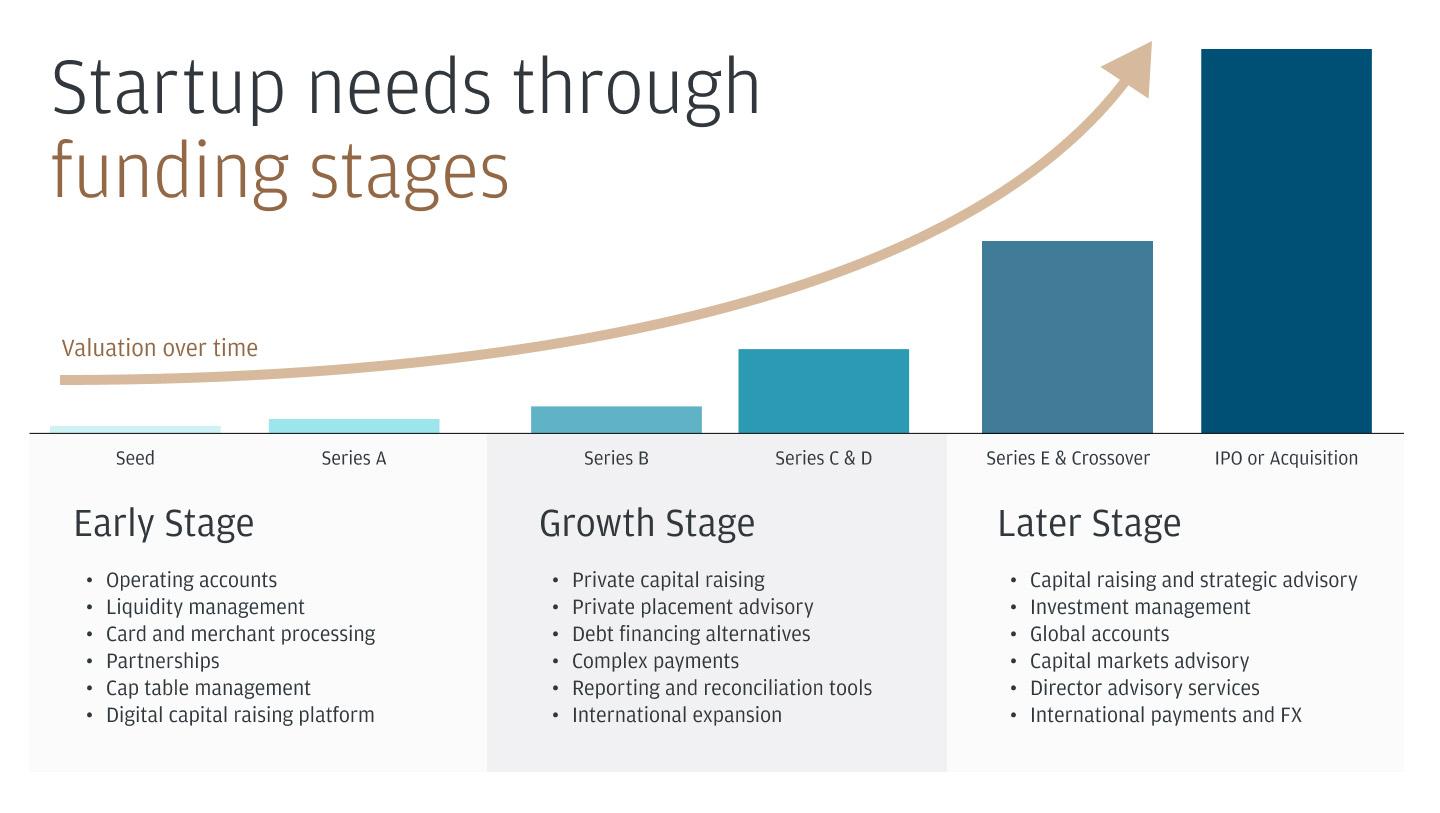

The recent wave of venture capital partners departing from large firms is creating ripples across the startup landscape. For emerging businesses, this shift can lead to both opportunities and challenges. With seasoned investors venturing into smaller,more agile funds or launching their own initiatives,they bring valuable experience and established networks.This could enhance the chances for startups seeking funding from those who understand the intricacies of their sectors. Moreover, as established firms focus on stabilizing their core operations, startups might find themselves with less competition for funding, allowing them the space to innovate and grow.

However, the impact is not entirely positive. The uncertainty surrounding this transition can create trepidation among investors, leading to a more cautious approach towards funding new ventures. Startups may experience delays in securing necessary capital as venture partners reassess their strategies and align with new associates.In this environment, it becomes crucial for emerging businesses to hone their pitches, demonstrate robust value propositions, and forge strong relationships with potential investors. Being adaptable and understanding the evolving dynamics of venture funding will be essential in navigating this changing landscape.

Navigating the New Landscape: Strategies for Investors and Founders

as waves of venture capital partners migrate from established firms to forge their paths, both investors and founders must recalibrate their strategies to stay ahead in this evolving ecosystem. This trend underscores the shifting allegiances within the industry, prompting a re-examination of relationships and investment philosophies. Entrepreneurs should focus on establishing authentic connections with potential backers who resonate with their vision, emphasizing the importance of mutual alignment in values and long-term goals.Adopting a proactive approach can help founders discover emerging investors who are not encumbered by the legacies of larger firms, possibly offering more flexible terms and creative solutions.

For investors navigating this new landscape, maintaining agility is crucial. The exit of seasoned professionals from traditional firms can lead to opportunities for diversifying portfolios and reassessing risk factors. By engaging with early-stage ventures and emerging founders, investors can capitalize on unique market trends and innovative ideas that were previously overshadowed by larger, well-established competitors. Developing a keen understanding of niche markets and leveraging technology to streamline evaluations will empower investors to make informed decisions that reflect their appetite for growth in a climate marked by change and challenge.

The Future of Venture Capital: Adapting to a Changing Ecosystem

The landscape of venture capital is undergoing seismic shifts, driven by factors such as evolving market dynamics and a surging appetite for innovation. As traditional paths to funding become less predictable, many venture capitalists are pivoting toward smaller, more agile firms where the culture promotes rapid decision-making and a more personal touch. This trend of partner migration is a reflection of broader changes within the investment ecosystem that seeks flexibility and adaptability in the face of increasing competition and diverse startup landscapes. factors prompting these moves include:

- Desire for Autonomy: Many professionals are seeking the freedom to pursue their own vision without the constraints of large, bureaucratic structures.

- Innovation Focus: Smaller firms frequently enough prioritize disruptive technologies and progressive ideas, allowing partners to align their work with their passions.

- Enhanced Fundraising Capabilities: The rise of alternative funding sources, like crowdfunding and tokens, encourages a more democratized approach to venture funding.

As these shifts continue,the implications for both startups and investors are profound. The departure from established firms signals a potential repositioning of venture capital strategies, emphasizing relationships and community engagement over sheer volume. Smaller firms, driven by the individual goals of their partners, may become incubators for creativity and risk-taking, fostering an environment where groundbreaking ideas can thrive. This evolution is not merely a byproduct of current trends but may be the very foundation from which the future of venture capital emerges, characterized by a personalized approach and a robust focus on meaningful partnerships. In this new ecosystem, success will hinge on a firmS ability to adapt and resonate with the changing priorities of both investors and the startups they support.