The Surge of Crypto-Hoarding and Its Impact on Market Volatility

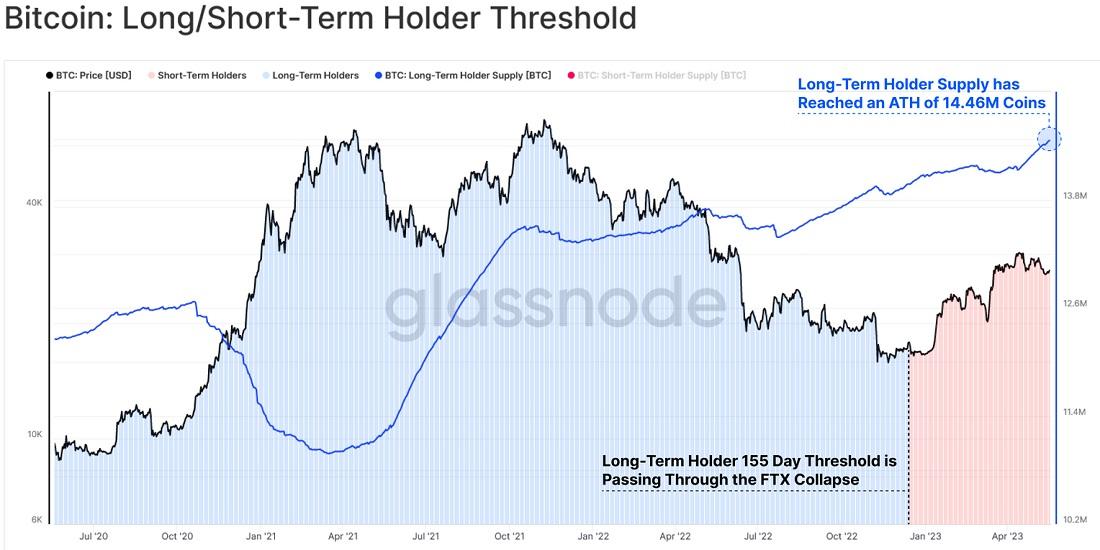

The recent uptick in crypto-hoarding is sending shockwaves through the financial community, as enthusiasts and investors alike grapple with the implications of holding vast reserves of digital assets. With an estimated $25 billion stashed away in various wallets, this phenomenon not only showcases the growing conviction in the value of crypto but also raises critical questions about liquidity and market stability. As wallets fill with dormant assets, experts warn that this trend could lead to increased market volatility when major players decide to liquidate or redistribute their holdings.

Several factors contribute to this emerging trend, including:

- Fear of missing out (FOMO) as prices surge, compelling holders to retain their investments in hopes of greater future returns.

- Market speculation that leads to hoarding as a strategy to capitalize on anticipated price spikes.

- Increased security concerns, prompting individuals to hold onto their assets for longer periods instead of risking potential losses through trading.

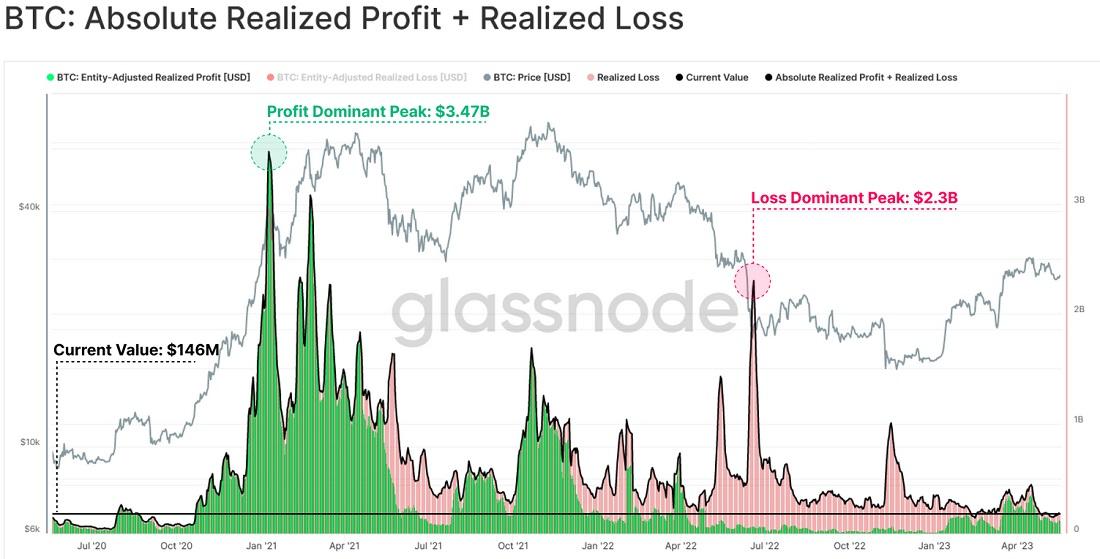

As more investors lean into hoarding as a strategy, the crypto market faces the dual challenge of managing inflated prices and ensuring adequate liquidity. The cascading effects of this behavior can lead to drastic fluctuations, creating an unpredictable environment that keeps regulators and investors on high alert.

Understanding the Psychology Behind the $25 Billion Frenzy

The recent craze surrounding cryptocurrency hoarding has sparked a interesting psychological phenomenon, intertwining human behavior with financial strategy. investors are drawn into this frenzy for various reasons, many of which stem from deeply ingrained psychological biases.FOMO, or the fear of missing out, plays a pivotal role, as individuals rush to purchase digital assets, fearing that they might loose out on potential profits. Additionally, the perception of scarcity in the crypto market fuels this irrational behavior; people believe that limiting supply leads to higher future valuations, prompting a rush to acquire as much as possible. Alongside this is the bandwagon effect,were individuals,influenced by their peers,tend to make investment decisions based on what others are doing rather then essential market analysis.

Furthermore, the allure of speedy wealth can lead to cognitive dissonance among investors, as many may overlook the inherent risks associated with such speculative assets. As they witness rapid price fluctuations, the sense of control and competence diminishes, yet the psychological drive to hold onto or acquire more can intensify. This duplication of irrationality serves to not only inflate asset prices but also creates a perilous volatility. investors find themselves in a tug-of-war between their instincts and market realities, leading to an environment where emotional decision-making predominates. The sheer scale of the market’s response-valued in billions-reveals just how powerful psychological factors can be in shaping financial landscapes, illustrating that the stakes extend well beyond mere investments; they touch on the fundamental human experience of risk, reward, and the pursuit of stability amidst chaos.

Navigating Risks: Strategies for Investors in a Tumultuous Landscape

The recent surge in cryptocurrency hoarding, accumulating to a staggering $25 billion, has sent shockwaves through the investment community, stirring concerns about market stability. As investors flock to digital assets at an unprecedented rate, the landscape grows increasingly volatile, prompting the need for a reassessment of risk management strategies.The following approaches can aid investors in navigating this tumultuous environment:

- Diversification: Spreading investments across a variety of assets to mitigate risk and reduce the likelihood of substantial losses.

- Due Diligence: Conducting thorough research before investing in cryptocurrencies,including analyzing project fundamentals and market trends.

- Setting Limits: establishing stop-loss orders to protect against extreme price fluctuations and secure profits when possible.

- Monitoring Regulatory Changes: Staying informed about evolving regulations that could impact the crypto market and adjusting strategies accordingly.

Amid this frenzy, investors must remain vigilant and adaptable.The volatility of the crypto market demands a proactive approach to risk management while capitalizing on potential opportunities. By implementing these strategies, investors can better position themselves to weather the uncertainties inherent in such a rapidly changing financial landscape.

Future outlook: Will the Craze Lead to Long-Term Changes in the Crypto Market?

The recent surge in crypto-hoarding, with a staggering $25 billion accumulated in various digital assets, presents a pivotal moment for the industry and its participants. Investors and analysts alike are closely monitoring the implications of such massive accumulation. The potential for long-term shifts in market dynamics is significant. Not only does this trend reflect a growing confidence in cryptocurrencies, but it also raises questions about liquidity and market volatility. Key factors that could influence these long-term changes include:

- Institutional Adoption: As more institutions enter the space, their strategies and approaches could reshape market structures.

- Regulatory Developments: Ongoing and future regulations will greatly impact how cryptocurrencies are traded and stored.

- market Sentiment: The psychological aspect of investing in volatile assets plays a crucial role in price movements and could lead to herd behavior.

With the current craze perhaps paving the way for a more mature market, participants must remain vigilant. Long-term implications could result in a more stable environment, provided that the infrastructure to support such growth is developed properly. There are also concerns about over-speculation and its repercussions. Should this trend turn into a bubble, the consequences could be severe, not just for individual investors but for the market as a whole. As the dust settles, only time will reveal if this frenzy marks the beginning of a new era for cryptocurrencies or if it will be remembered as a fleeting moment in a notoriously unpredictable landscape.