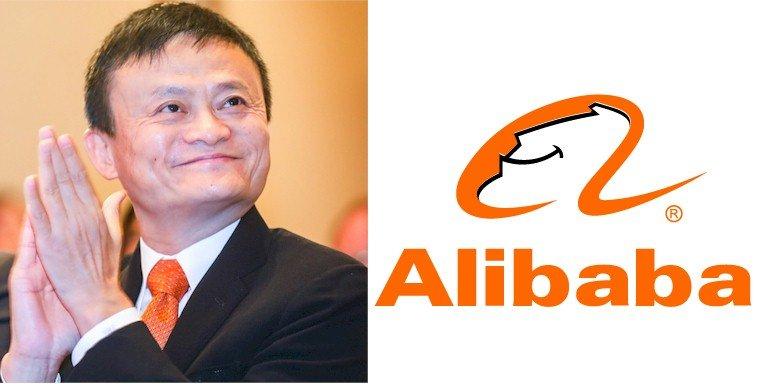

Alibaba and Baidu Drive Record Growth in Asia’s Equity-Linked Bond Market

In a remarkable presentation of market resilience, Alibaba and Baidu have emerged as pivotal forces propelling Asia’s equity-linked bond sector to unprecedented heights. These tech giants have successfully tapped into the growing demand for innovative financing solutions, capitalizing on investor appetite for hybrid instruments that blend equity and fixed income. Consequently, both companies executed substantial equity-linked bond sales, considerably contributing to a surge in market activity and reflecting broader investor confidence in the region’s economic recovery.

The surge in equity-linked bond offerings can be attributed to several key factors:

- Innovative Financing Solutions: Companies are increasingly turning to equity-linked bonds as a way to raise funds while minimizing dilution of ownership.

- Strong Market Sentiment: Investor enthusiasm has been bolstered by a favorable economic environment and improving corporate earnings.

- Strategic Growth Plans: Both Alibaba and Baidu have ambitious expansion initiatives that necessitate substantial capital, thereby driving the need for these financial instruments.

This trend not only highlights the resilience of Asia’s capital markets but also underscores the strategic positioning of major tech firms in navigating the rapidly evolving landscape of investment financing.

Investment Strategies Amid Rising Demand for equity-Linked Bonds

The recent surge in equity-linked bond sales, led by tech giants like Alibaba and Baidu, reflects a shift in investor appetite as the search for yield intensifies amid low interest rates. Market analysts indicate that these innovative financial instruments offer a unique combination of potential equity recognition and bond-like stability,making them an attractive option for cautious investors looking for diversification in their portfolios. With traditional fixed-income securities yielding less, equity-linked bonds present an appealing alternative by allowing investors to benefit from the equity market’s upside while mitigating risks associated with direct stock purchases.

As companies increasingly turn to these bonds to raise capital, several strategies are emerging for investors keen on capitalizing on this trend:

- Understanding Volatility: Investors should assess the underlying stock’s volatility, as equity-linked bonds ofen depend on stock performance for returns.

- Company Fundamentals: Analyzing a company’s financial health and growth projections can provide insights into potential share price movements.

- Diversification: Spreading investments across different sectors and companies can reduce risk, especially in a fluctuating market.

- Monitoring Market Sentiment: Keeping an ear on market trends and investor sentiment is crucial, as shifts can influence bond performance.

By implementing these strategies, savvy investors can navigate the complex landscape of equity-linked bonds and position themselves to benefit from the shift toward this innovative financing solution.

Market Analysis: Implications of tech Giants’ Bond Sales on investor Sentiment

In a striking shift within Asia’s financial landscape, the recent surge in equity-linked bond sales led by tech giants such as Alibaba and Baidu has significant implications for investor sentiment. this influx of capital from established firms is reshaping perceptions of risk and opportunity in a region that has seen fluctuations in tech valuations. Investors are carefully observing this trend, which may indicate a broader confidence in the recovering market and could encourage more companies to explore similar financing routes. The following factors contribute to this evolving investor sentiment:

- Enhanced Liquidity: the increased bond issuance reflects heightened liquidity in the tech sector, which might repair the confidence that had been dwindling amid regulatory challenges.

- Institutional Support: Major institutional players backing these bonds suggest a return to bullish strategies aimed at capturing growth in the quickly evolving digital economy.

- Diversification Appeals: As equity-linked bonds offer hybrid characteristics,the opportunity for stable income while perhaps benefiting from equity upside attracts a wider range of investors.

Moreover, the implications extend beyond immediate financial metrics; they serve as a litmus test for how investors view the long-term trajectory of tech companies in Asia. Market analysts predict that sustained activity in this space could stimulate further interest in technology stocks, invigorating a potentially stagnant market sector. The tech giants’ ability to tap into cheap financing amidst global interest rate fluctuations underscores their resilience and prompts questions about the sustainability of such rapid growth. Consequently, the current climate prompts investors to recalibrate their strategies with an eye toward potential long-term gains, especially in the equity-linked avenue. Key considerations include:

- Regulatory Adaptation: Keeping track of how regulatory policies evolve will be vital for assessing future investment risks.

- Innovation Trajectory: Evaluating ongoing product developments and technological advancements within these companies may signal additional growth opportunities.

- Global Economic Influence: Understanding how external economic factors impact these markets is critical for making informed investment choices.

Future Outlook: Navigating Risks and Opportunities in Asia’s Equity-Linked Landscape

The recent surge in equity-linked bond sales, spearheaded by industry giants like Alibaba and Baidu, underscores a pivotal shift within Asia’s financial markets. As companies leverage these instruments to raise capital while providing investors with the upside of equity participation, the stage is set for both risks and rewards. The adaptability of businesses in navigating regulatory landscapes, combined with the evolving demand from investors seeking growth, creates a unique dynamic. In a region where technology and traditional finance converge, the potential is immense, yet navigating this landscape will require a discerning eye.

Key factors shaping the trajectory of equity-linked bonds in Asia include:

- Regulatory Changes: Staying abreast of shifting regulations can mitigate risks and identify opportunities for new issuances.

- Market sentiment: Understanding investor appetite for risk will be crucial as sentiment can significantly impact performance.

- Technological Advancements: The rise of fintech solutions may enhance the efficiency of bond structuring and trading processes.

- Global Economic Indicators: Monitoring international economic trends will provide insights into potential impacts on local markets.

Companies that strategically position themselves to navigate these elements will likely emerge as leaders in this burgeoning sector. Continued innovation and responsiveness to market demands will be essential for entities aiming to capitalize on the equity-linked bond boom in Asia.