Exploring the Benefits of Home Equity Loans for Ambitious Homeowners

For homeowners looking to finance their aspirations, tapping into home equity can be a powerful financial strategy. Home equity loans allow you to borrow against the value of your home, leveraging the investment you’ve already made. This type of financing often comes with lower interest rates compared to credit cards or personal loans, making it an attractive option for those ready to take on new projects or investments. Use these funds wisely, and they can facilitate substantial improvements or create opportunities that positively impact your long-term financial stability.

Whether you’re planning to renovate your kitchen, invest in a rental property, or consolidate high-interest debts, the advantages of a home equity loan are numerous. Consider the following benefits:

- Accessibility: With increasing home values, many homeowners discover they have more equity than they realized.

- Tax Deductions: In some cases, the interest on home equity loans may be tax-deductible, which can provide further financial relief.

- Flexibility: Home equity loans offer various lending options, allowing you to choose the one that fits your plans best.

- Fixed Rates: Many home equity loans feature fixed interest rates, creating predictable monthly payments that simplify budgeting and financial planning.

Understanding How to Leverage Your Homes Value for Dreams

When it comes to achieving your dreams, your home can be a powerful ally. By tapping into your home’s equity, you can unlock funds that may be used for a variety of life’s aspirations. Think about the possibilities: renovating your kitchen to create that culinary haven you always wanted, starting a business that fuels your passion, or even financing a dream vacation that you’ve always envisioned. Home equity loans offer a way to transform your living space and life significantly, all while leveraging an asset you already own.

It’s essential to approach this opportunity wisely. Begin by assessing your home’s value and how much equity you have built over the years. Consult with a financial advisor to craft a plan that aligns with your goals and ensures that you will manage the repayments comfortably. Remember, a home equity loan is not just a financial tool, but a stepping stone toward your larger ambitions. Keep in mind the following considerations:

- Interest Rates: Compare rates to find the most favorable terms.

- Loan Terms: Understand the repayment period and structure.

- Purpose of the Loan: Ensure the project aligns with your long-term financial strategy.

- Risks: Be aware of the consequences of falling behind on payments.

Key Considerations Before Taking Out a Home Equity Loan

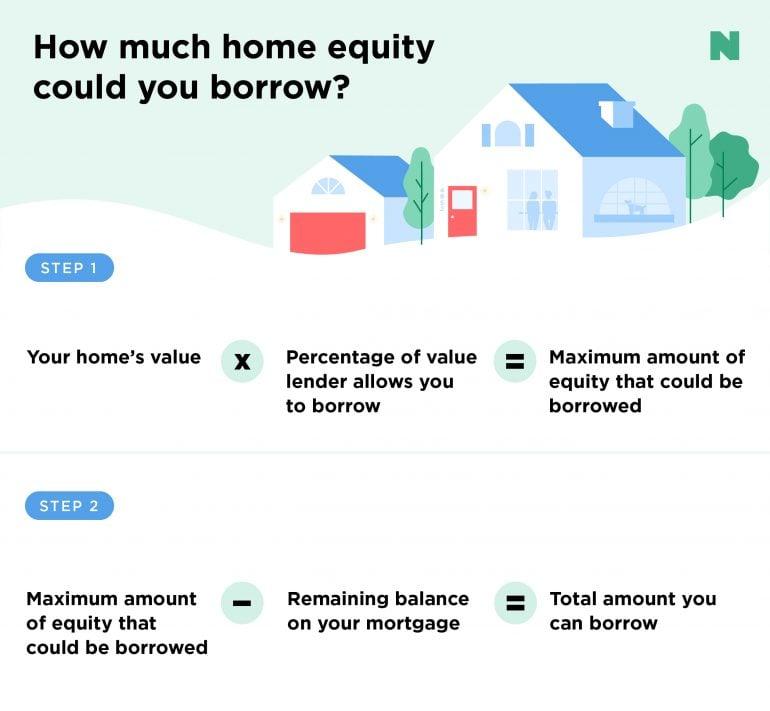

Before making the leap into the world of home equity loans, it’s essential to evaluate your financial circumstances meticulously. Consider your home’s market value and the existing mortgage balance to understand how much equity you can access. Additionally, assess your current financial obligations to ensure that adding another layer of debt won’t stretch your budget too thin. Here are some key factors to keep in mind:

- Interest Rates: Compare rates from multiple lenders to secure the most favorable deal.

- Loan Amount: Determine how much you need versus how much you qualify for based on your equity.

- Fees and Closing Costs: Factor in any additional costs that come with securing the loan.

Another crucial element is the potential impact on your financial future. Home equity loans are secured by your property, which means failure to repay can lead to foreclosure. Assess how the loan aligns with your long-term objectives. Are you funding a renovation that will increase your home’s value, or are you consolidating debt? Understanding the purpose of the loan can help in making sound financial decisions. Consider these aspects:

- Loan Duration: How long do you plan to take to repay, and does that fit your financial goals?

- Flexibility: Will you require the ability to adjust payments if your financial situation changes?

- Your Market: Be aware of local property values and overall market trends that could affect your home equity.

Smart Strategies for Using Loan Proceeds Effectively

When embarking on the journey of utilizing a home equity loan, it’s essential to implement a thoughtful strategy for deploying those funds. Start by clearly defining your financial goals; this clarity will not only guide your spending but also ensure that you’re maximizing the potential of your investment. Consider using a portion of the loan for significant home improvements that can boost your property value, such as:

- Kitchen renovations, which often yield high returns.

- Bathroom upgrades that enhance comfort and functionality.

- Energy-efficient installations that can save on utility bills.

Additionally, think about leveraging your loan to consolidate higher-interest debts, which can streamline your payments and reduce overall interest expenses. Another smart use of equity loans is to invest in promising opportunities, such as starting a small business or funding education expenses, which can lead to long-term financial gains. Remember, the key is to maintain a balanced approach — ensuring that every dollar spent is accounted for and aimed toward fostering stability and growth in your financial landscape.