Starling Bank’s Strategic Move: Analyzing the Expansion into the US Market

starling bank’s recent decision to explore the *U.S. market* signifies a bold and calculated step in its growth strategy. By looking to acquire a U.S. lender, the UK-based mobile bank aims to leverage the vast potential of the North American banking landscape. This strategic move could transform starling from a prominent player in the UK to a competitive force in the global arena. potential benefits of this acquisition include:

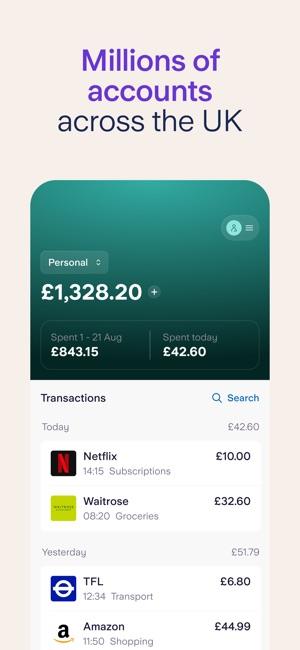

- access to a Larger Customer Base: The U.S. market presents an opportunity for Starling to reach millions of new customers seeking innovative banking solutions.

- enhanced Product Offerings: By integrating local banking knowledge, Starling could tailor its services to meet the unique needs of American consumers.

- Increased Brand Recognition: Establishing a presence in the U.S. would elevate Starling’s profile, enhancing its reputation as a global fintech player.

However, entering such a competitive marketplace comes with its set of challenges. The regulatory landscape in the United States is complex, requiring thorough compliance with both federal and state regulations. Moreover,the presence of established banking institutions means Starling will need to differentiate itself effectively. To navigate these hurdles, the bank must focus on several key strategies:

- Technological Innovation: Starling should leverage its cutting-edge technology to offer user-pleasant and efficient services that set it apart.

- Partnerships and Collaborations: Establishing alliances with local financial entities could facilitate smoother entry and help in gaining immediate market insights.

- Customer-centric Approach: Prioritizing customer experience and feedback will be essential in adapting offerings to suit american consumers’ preferences.

Potential Targets: Key Factors for Starling in Acquiring a US Lender

As Starling embarks on its aspiring plan to acquire a US lender, several key factors will play a pivotal role in determining the success of this strategic move. Market Fit is essential; the bank must assess whether potential targets align with its innovative banking model and can complement its existing services. Additionally, regulatory compliance cannot be overlooked, as navigating the complex US banking regulations will be a critical hurdle. It is indeed vital for Starling to identify lenders that have established compliance frameworks to ensure a smooth transition and operations moving forward.

Another crucial aspect is customer base; Starling should seek out lenders that possess a robust and engaged clientele that can transition to its platform. Moreover, technology infrastructure is a priority; acquiring a bank with advanced tech systems can accelerate Starling’s integration and enhance its service offerings. Lastly, cultural fit will influence the merger’s success; understanding the ethos of a target lender can determine how well they integrate into Starling’s work habitat and corporate beliefs, ultimately affecting employee retention and customer satisfaction.

Navigating Challenges: Regulatory Hurdles and Market Competition in the US

As Starling moves forward with its ambitious plans to acquire a U.S. lender, the company faces a complex landscape fraught with regulatory challenges that could shape the trajectory of its expansion. The U.S. banking sector is governed by a myriad of federal and state laws designed to ensure consumer protection,financial stability,and competition. Starling must navigate these regulatory waters by:

- Securing necessary licenses: obtaining the required banking licenses can be a time-consuming process, requiring compliance with both federal and state agencies.

- Understanding local regulations: Each state has unique financial regulations that the bank must adhere to, adding an additional layer of complexity to the acquisition.

- Addressing anti-money laundering (AML) laws: With stringent AML practices in place, the bank must ensure robust systems to combat financial crime as part of its operational framework.

Along with regulatory obstacles, Starling is entering a fiercely competitive market where established players dominate. The U.S. banking environment is characterized by a mix of customary institutions and fintech disruptors all vying for market share. To carve out a niche and establish a foothold, Starling must differentiate itself by:

- Leveraging technology: The bank’s advanced digital banking services must stand out in a crowded field, highlighting innovative features that enhance user experience.

- Building partnerships: Collaborating with local fintechs and business networks can provide valuable insights and access to a broader customer base.

- Focusing on customer service: Remarkable customer support and engagement strategies will be critical in winning over potential customers from established brands.

Future Opportunities: How Starling Can Leverage its UK Success in America

The recent expansion of Starling Bank from the UK into the American market presents a myriad of future opportunities that could considerably enhance its footprint and customer base. By targeting a US lender for acquisition, Starling can harness not onyl its established reputation but also the growing demand for fintech solutions across the pond. With consumers increasingly seeking streamlined banking experiences and personalized financial services,Starling’s innovative technologies and customer-centric approach could resonate well with American users. This strategy allows Starling to leverage its UK success, translating hard-won lessons into a new context where competition is steep but the rewards are perhaps ample.

In pursuing US expansion, Starling can capitalize on several key advantages:

- Brand Recognition: Utilizing its award-winning status in the UK could help gain trust among skeptical American consumers.

- Strategic Partnerships: Collaborating with local fintech companies could offer insights into regional preferences and regulatory challenges.

- Diverse Product Offerings: Expanding its product suite to include services specifically tailored to American households can drive customer acquisition.

- Data-Driven Insights: leveraging advanced analytics to understand customer behaviors and optimize products in real-time.

By focusing on these elements, Starling can not only establish a firm foothold in the American banking landscape but also position itself as a prominent player in the increasingly competitive world of digital finance.